The Social Structure of Organizational Change and Performance

Desmond Ng

University of Alberta, USA

Introduction

Social systems—organizations, institutions, and markets—have been characterized by social scientists as complex entities. From the Scottish philosopher Hume to Adam Smith and Austrian economist Hayek, markets were viewed as complex systems with spontaneously emergent or market-ordering properties. Although developed under the domains of natural and physical sciences, Poincaré and later Prigogine were principal to the development of what is called the emerging field of complexity science (Rosenhead, 2001). Although there is no general consensus on the definition of complexity, a complex system is often described as a system containing numerous interacting subcomponents whose interactions yield complex behaviors of chaos, order, and edge of chaos (Jantsch, 1980; Kauffman, 1995). With the increasing complexity of organizations and markets, management scientists have drawn on the properties and principles of complexity science to better explain social systems as complex adaptive systems (Marion, 1999; Stacey, 1995).

In management research, complexity science has been an emerging direction for the scholarship of organizational change and performance (Brown & Eisenhardt, 1998; Garud & Van De Ven, 2002; Levinthal, 1997, 2002; Levinthal & Warglien, 1999; McKelvey, 1999). Complexity appreciates the “duality of interactively complex systems” in which “duality” refers to the idea that “any action produces a ripple effect, on interdependent actors—the ‘structure'. This ripple effect, in turn, shapes actions” (Garud & Van De Ven, 2002: 220). From a complexity point of view, organizational change and performance need to be understood in increasingly systemic terms (see Levinthal, 1997, 2000; McKelvey, 1999). A systemic orientation views organizational change and performance as a socially embedded process; organizations are interdependently related in complex and socially structured arrangements (Garud & Van De Ven, 2002).

One area of change management research emphasizing systemic interactions is complementarity theories (Dyer & Singh, 1998; Levinthal, 2002; Matsuyama, 1995; Teece, 2000; Whittington et al., 1999). Complementarity theories have a systemic orientation that “insists on a simultaneously aggregated and disaggregated analysis, both to define the conditionality of individual effects on other effects and to ensure full system effects outweigh individual component effects” (Whittington et al., 1999: 588). In the presence of complementarities, the performance associated with organizational change is dependent on other complementary changes (Whittington et al., 1999).

Based on this notion of complementarities, a “socially” complex framework of organizational change and performance is proposed. In drawing from the burgeoning interests in social network research, this article argues that the structure of complementary interactions within a social network affects the performance and change behavior of organizations. This social structure is examined by proposing an S (Strength of complementary relations) P (organizational Power) D (Diversity of organizational resources) framework. This framework proposes that these dimensions of social structure—social structural factors—are mutually interdependent in influencing organizational change and performance. It favors complexity perspectives in addressing one of the key challenges of change and performance in strategic management research. In particular, a systemic approach to understanding organizational change and performance is advocated; it advocates extending the unit of analysis beyond the organization to include an organization's interdependence with a greater social structure. This is an area that has received growing interest from organizational change researchers (Garud & Van De Ven, 2002)

CONCEPTUAL FOUNDATIONS

The concept of complementarities has been increasingly recognized as a source of interorganizational rent or “social capital” (Dyer & Singh, 1998; Levinthal, 2002; Powell et al., 1996; Teece, 2000). Complementarities are described using numerous terms, such as the positive cross-marginal productivity of capital, synergies, complementary resource endowments, complementary assets, or complementary capabilities (Davis & Thomas, 1993; Dyer & Singh, 1998; Teece, 2000; Whittington et al., 1999).

Complementarities rest on an underlying assumption that the resources and capabilities of an organization are heterogeneous. This is an argument promoted earlier by the Austrian economist Lachmann. In his theory of capital structure (Lachmann, 1947), the capital goods or resources used by organizations within a market are structured in a complex pattern of complementary relationships. Because of this capital structure, changes in the productivity of one organization's resources can have unpredictable effects on the resources used by other organizations (Lachmann, 1947, 1977). Since the assumption of resource heterogeneity denotes the presence of complementary relationships (Lachmann, 1947, 1977), these complementary relationships can exist internally to the resources used by an organization as well as externally to resources used by other organizations.

Hence, in the presence of complementarities, the competitive performance of resources held in an organization depends on its relationship to other resources used within the organization as well as to resources used by other organizations (Teece, 2000; Teng & Cummings, 2002). Because of these relationships, resource recombinations result in “a synergistic effect whereby the combined resource endowments were more valuable, rare and difficult to imitate than they had been before they were combined” (Dyer & Singh, 1998: 667). Sources of wealth creation, therefore, are not exclusive to the internal and mutually independent resources of an organization (Teng & Cummings, 2002), as championed by the ubiquitous resource-based view (RBV; Barney, 1991). Rather, internal and in particular external complementary relationships are important sources of competitive performance (Dyer & Singh, 1998; Teng & Cummings, 2002).

CONCEPTUAL MODEL OF ORGANIZATIONAL CHANGE AND PERFORMANCE

As a complex system is often depicted as a system of heterogeneous and interacting elements (Jantsch, 1980; Kauffman, 1995), the heterogeneous resources and resulting complementary interactions (internal and external to the organization) are instrumental to investigating the complex properties of such social interactions. Specifically, a socially complex system consists of widely dispersed organizations with heterogeneous resource capabilities. Their complementary interactions create complex dynamics that influence the magnitude of organizational change and performance.

This is examined by proposing an S-P-D framework that identifies social structure in terms of three social structural factors that determine organizational change and performance. The S-P-D framework proposes that the Strength (S) of complementary relations (internal and external to the organization), organizational Power (P), and organizational resource Diversity (D) affect the type of organizational change (incremental or radical) and the sustainability of organizational performance. Each of these structural factors was inspired by complexity science (Kauffman, 1995), resource dependence (Pfeffer & Salancik, 1978; Thompson, 1967) and social network (Feld, 1981; Granovetter, 1983) thinking respectively.

For instance, Levinthal (1997, 2002), Levinthal and Warglien (1999) and McKelvey (1999) have applied Kauffman's (1995) fitness landscape model to explain organizational change and performance. They attribute the degree of “epistatic” couplings or organizational interdependence as an important contributing factor. The strength (S) of complementary relations uses this notion of “epistatic couplings.” However, its use is also influenced by Lachmann's (1977) concept of “capital structure.”

The concept of organizational power (P) is rooted in the resource dependence arguments of Pfeffer and Salancik (1978) and Thompson (1967), in which they contend that organizational power influences the process of control. Thus, the concept of power is used to influence the degree of organizational change among interdependent members. This concept of power is adapted to include the role of complementarities and extends fitness landscape arguments to include the social influence of power.

The concept of organizational resource diversity (D) stems from the assumption of resource heterogeneity. It is rooted in Lachmann's (1947, 1977) concept of capital and it is also a central premise of the resource-based view (Barney, 1991). The concept of resource diversity is used to explain the “transitivity” (Feld, 1981; Granovetter, 1983) of network structures. Feld (1981) and Granovetter (1983) suggest that transitive or closed networks tend to restrict organizational change behaviors and, thus, tend to create more stable social systems. However, this article extends this position to suggest that the degree of organizational resource diversity influences not only tendencies for network transitivity, but, depending on its relationship to the other social structural factors, it can have differential impacts on the magnitude of organizational change and the sustainability of organizational performance. Each of the components of the S-P-D framework is described below.

STRENGTH OF COMPLEMENTARY RELATIONS (S)

The strength of complementary relations is defined with respect to the number of internal and external complementary interactions. Organizations with strong and weak complementary relations are defined as organizations with a high and low number of complementary interactions (internal and external) respectively.

Stated in the language of complex fitness landscapes, the number of internal and external complementary interactions is analogous to Kauffman's (1995) notion of epistatic couplings, as seen in his examination of NKCS fitness models. The number of internal complementary relations is analogous to the K espistatic couplings of NKCS fitness models. K epistatic interactions refer to the number of interactions among the genes of an organism, which also determines its overall fitness. The internal complementary interactions between the resources of an organization exhibit such interrelationships in which their combined influence can contribute to nonlinear performance gains (Whittington et al., 1999). In addition, according to Kauffman (1995), the C epistatic interactions refer to epistatic links that are external to an organism. This can be similarly cast in terms of an organization's external complementary relations, such as synergies between strategic alliance partners. As described by Dyer and Singh (1998), these external complementary relationships are sources of interorganizational rents or social capital.

However, in spite of the similarities to Kauffman's (1995) fitness landscape, one important distinction is that these epistatic links are endogenously determined by the pattern of organizational resource choices in the marketplace. This follows directly from Lachmann's (1947) theory of capital structure, where the capital or resource structure of a market evolves with changes in the resource choices of its subjective individuals. Since Lachmann views individual choices as primarily subjective (Lachmann, 1977), one cannot predict the changing use of resources and their resulting complementary or epistatic relationships. The capital structure and the complementary incentives that define such a structure are, therefore, endogenously driven by the subjective changes in resource use. While, according to fitness landscape models, an organism's fitness and its epistatic couplings are exogenously determined, in social systems they are not.

With this characterization, the strength of an organization's complementary relations (S) directly affects the type and duration of organizational change. Organizations with strong complementary relations are more likely to conduct radical change initiatives (Whittington et al., 1999). Due to high levels of interdependence, strong complementary relations suggest that a change in one resource can have multiple impacts on other resources, internally and/or externally to the organization. Changes in these resources can subsequently stimulate further resource changes and thus create radical changes that depart from an organization's initial resource choice.

For instance, in terms of strong external complementary relations, the implementation of food brands containing information-traceable attributes (i.e., origin of production, use of genetically modified inputs, animal welfare practices, production practices involving absence or use of pesticides, etc.) in the food retail sector affects in various ways the production and processing activities of upstream members (farmer producers and food processors). This includes the use of identity-preservation systems that trace food information attributes from farm production to food processing, and food production and distribution logistics involving food-handling protocols that prevent commingling of attribute-specific food products with non-attribute-specific food groups. As a result, given complementarities between the adjacent stages of a food supply chain, changes in food-branding practices can create radical changes in production technology and processing practices to upstream supplying sectors.

Complementarities internal to the organization are another important dimension. Teng and Cummings (2002) state that the interrelationships of resources across functional areas of an organization need to be understood in systemic terms, otherwise exclusive attention to key core competences in one area can unintentionally diminish other competencies. For instance, the competitive advantage of the grocery chain Food Lion relied exclusively on cost control, but failed to develop other resources such as relationship capital (Teng & Cummings, 2002). By understanding these interdependencies—in systemic terms—changes in resource use will not be done in isolation but will rather involve changes in the organization's overall resource configuration (Teng & Cummings, 2002). That is, in the presence of strong internal complementary relations, changes in one resource or area of core competence would require concurrent changes in other resources of the organization.

For instance, the development of film-based instant photography (Polaroid) required the redesign of the camera and film, and recent developments in automobile design such as the Hy-Wire auto chassis by General Motors entail fundamentally different requirements in car body construction. As described by Teece (2000), such changes lead to “systemic innovation” where changes in one part of the system lead to adjustments to other parts of the system. Whittington et al.'s (1999) empirical research also supports the notion that organizations with high complementary assets have tendencies to undertake large-scale, as opposed to piecemeal and incremental, changes. In addition, since the strength of complementary relations is likely dependent on the proportion of organizational resources that are sensitive to internal and external complementarities,1 resources sensitive to such relations will more likely be subject to radical organizational changes (Dyer & Singh, 1998). Taken together, increasing complementary relations increase an organization's susceptibility to radical changes.

As organizational change is a process of combinatory search (Levinthal, 2002; Matsuyama, 1995), this radical change provides search over a greater space of potential complementary configurations than would have been possible with incremental/piecemeal change. As a result, the strength of an organization's complementary relations positively influences the likelihood of radical change and subsequently reduces the duration or time required to find desirable performance outcomes. In increasingly competitive and dynamic markets, this ability translates into more rapid responses to the development and adoption of new technologies and thus can be a source of competitive advantage. However, at the same time radical innovations invite greater risk, such as first-mover (dis)advantage. Hence, although increasing the strength of complementarities can increase organizational performance, the variability in performance is also increased.

ORGANIZATIONAL POWER (P)

Although the strength of complementary relations determines the degree to which organizational resources are interrelated—internally and /or externally—these relationships are also subject to asymmetrical or nonuniform influences. In particular, the strength of external complimentary relations determines the span of influence that organizational resources have in affecting the resources of their network members. Some of these complementary relations can have more of an impact on some network members than others because certain combinations of resources can affect network members differentially. For instance, organizations holding a large proportion of assets that are cospecialized with resources of another organization(s) are affected differently than organizations with no cospecialized resources.

In life science industries, such as crops, seeds, and nutraceuticals, key commercializing assets in terms of processing and production technologies that utilize gains in scale economies, distribution and transportation logistics, and market branding are held by larger life science companies. These assets are instrumental to commercializing the possibilities from basic R&D innovations of smaller startup biotechnology organizations (Kalaitzandonakes & Bjornson, 1997; Teece, 2000). As a result, the strength of complementary relations needs also to include an asymmetrical component.

The asymmetrical aspect of the strength of complementary relations is cast in terms of the influence of organizational power within a social structure. Socioeconomic researchers have argued that the structure of social networks affects organizational behavior (Pfeffer & Salancik, 1978; Powell et al., 1996; Smelser & Swedberg, 1994; Thompson, 1967). According to resource dependence theory (Pfeffer & Salancik, 1978; Thompson, 1967), organizations are embedded in an environment consisting of other organizations and depend on those organizations for the resources they require. Organizations are dependent on an external environment of resources held by outside actors. As such resources affect the survival of organizations, focal organizations are confronted with the problem of controlling for such interdependencies. Thus, organizational power is a form of interorganizational control that “involves a process in which both the influencer and the focal organization act to affect the conditions governing the influence process” (Pfeffer & Salancik, 1978: 45).

Organizational power reflects an asymmetric relation of unbalanced reciprocity and is measured by social network measures of centrality (Burt, 1992; Powell et al., 1996). Following from resource dependence arguments, organizations with complementary resources, especially in conjunction with strong external complementary relations,2 should exert greater power and control in the use of resources by network members. That is, an organization's power is directly influenced by the degree to which its resources are complementary to external members.

For instance, in the development of VCR standards (Beta and VHS; Cusumano et al., 1992) JVC, the developer of the VHS standard, formed a strategic alliance with its parent organization, Matsushita, to exploit its generic skills in mass production and distribution. In addition, alliances with peripheral component producers (i.e., users and producers of VHS tapes) were instrumental to VHS's dominance. The underlying complementarities found between JVC and Matsushita's production and distribution exhibited considerable influence to peripheral component players that led to the eventual dominance of the VHS standard.

Therefore, constituting a form of a positive network externality, organizations with complementary resources are likely to enforce power among network members by rendering network members dependent on the complementary resources held by the focal organization. By the nature of its influence, such an organization can set the terms of resource use within a network in a manner that reinforces its central position. Thus, organizational power tends to increase organizational performance.

Power can also lead to the “tipping” of industry standards toward those resources and technologies that reinforce the central position of the focal organization, for example Microsoft. In addition, due to its centralized network position, power provides the focal organization with information-rich positions, allowing such an organization more timely access to new technologies and resources. Powell et al.'s (1996) empirical study of interorganizational collaborations in the biotechnology industry supports such a position, whereby organizations located in central network positions are more likely to derive performance gains from the assimilation of interorganizational knowledge experiences and obtaining R&D collaborations.

In addition, organizational power also derives further performance enhancements from other network externality effects. Within a network, complementary resources are subject to self-reinforcing effects or cumulative complementary influences (Matsuyama, 1995). For instance, computer hardware and software are complementary industries where, in a self-reinforcing fashion, product development in one industry positively supports the sales in the other.

With respect to organizational change, since power yields a certain degree of control on the resources of external members, and given that the external members' resources contribute to the performance of the focal organization, power can create “inertial or lock-in” (Arthur, 1989) behaviors. This mitigates against radical organizational change. In the parlance of complexity terminology, power is a form of nonlinear negative feedback that drives ordering tendencies in the capital structure. Organizations subjected to the power influences of a focal organization are coerced into choosing those resources that support the power position of the focal organization. The formation of complementary resources among network members can create alliance-specific exchange relations that are resistant to change (Dyer & Singh, 1998). As a result of organizational power, a form of network myopia can result from these complementary relations. Therefore, due to the inertial tendencies that support the central position of the focal organization, organizations subjected to power influences are expected to undertake incremental changes and such changes will occur over prolonged periods.

Moreover, according to institutional perspectives, radical changes constitute non-legitimized organizational practices (Scott, 1995) in so far as they are not sanctioned by organizations of power. Radical changes are resisted as they fundamentally alter the complementary resource configurations among network members and, thus, erode the basis of organizational power. Because of these influences, organizational power will tend to create more coordinated capital structures. Hence, unlike Lachmann's “radical subjective position” contending that markets are in continued disequilibrium (Lachmann, 1977), organizational power tends to coordinate resources that exploit complementary arrangements.3

ORGANIZATIONAL RESOURCE DIVERSITY (D)

In so far as organizational power positively influences the performance of organizations, the sustainability of organizational performance is contingent on the diversity of resources employed. In building on the assumption of resource heterogeneity, the organizational diversity is defined in terms of an organization with multiple divisions (i.e., functional divisions or strategic business units) with diverse areas of competence. For instance, a conglomerate corporation or multinational organization exhibits such characteristics of organizational resource diversity. Organizations with strong resource diversity will tend to create “transitive” or “closed” networks of interorganizational relationships.

Transitivity refers to tendencies where “two individuals who are both tied to a third are to also be tied to each other” (Feld, 1981: 1022). Put another way, transitive networks tend to yield the formation of a closed cluster of interorganizational relationships where each organization (i.e., a corporation) is connected directly or indirectly to other organizations (i.e., another corporation) in the network. Transitive networks can lead to the formation of group identities or group community structures (Granovetter, 1983; Nahapiet & Ghoshal, 1998). Transitivity can occur when an organization's resource diversity increases. This is because increasing the heterogeneity of organizational resources increases the likelihood that the resources will exhibit complementarities to resources used by network members; this thus increases the likelihood of forming a transitive or closed network of complementary relationships. This transitive network reflects an “ideal” state described by Lachmann's capital structure, where each organization is directly or indirectly complementary to every other organization in the market (Lachmann, 1947, 1977).

Membership within such networks confers sustainable and performance-enhancing effects. With this “closed loop” of complementary relations, the resources of each organization reinforce the performance of other organizations in this transitive network.4 This has a tendency to derive direct and indirect synergistic effects from this “closed network” structure in which it serves to increase and sustain network performance. With such incentives, this reduces the incentive for organizations to deviate from those complementary resources dictated by the structure.

There are also countervailing effects where the internal competition within a closed network structure can reduce the sustainability of the network performance. But, due to the reinforcing performance influences of a closed complementary network structure, there is greater sustainability and performance relative to competitive market environments. This is because under perfectly competitive market conditions organizations are characterized by homogeneous resources and therefore limited organizational resource diversity. This limits the potential to express the sustainable performance advantages of a closed or transitive network structure.

S-P-D INTERACTIONS ON ORGANIZATIONAL CHANGE AND PERFORMANCE

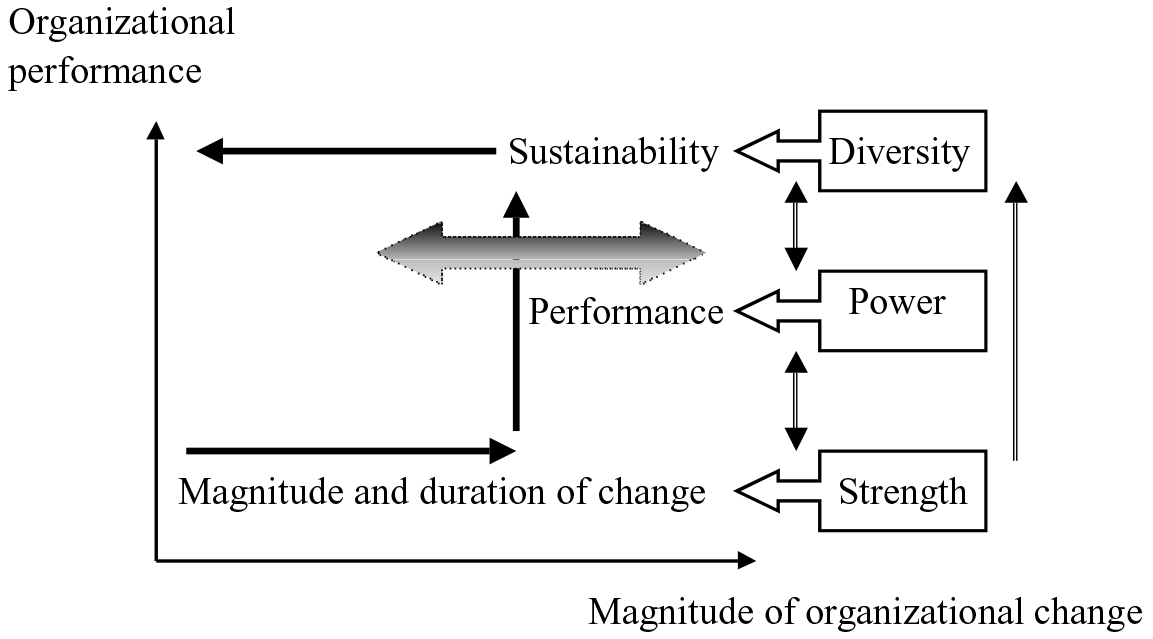

Figure 1 shows the relationship between the arguments of the S-P-D framework and its impact on organizational change and performance. As described by Whittington et al. (1999), organizational performance and change are expressed in terms of a J curve relationship. This J curve relationship shows that organizational performance and the magnitude (incremental vs. radical) of organizational change5 are influenced directly and collectively by the three structural factors of the S-P-D framework. These interrelationships are extended and elaborated on in the following discussion.

STRENGTH AND POWER

The strength (S) of complementary relations (internal and external to the organization) has a tendency to amplify the effect of organizational power incremental change. Increasing the strength, especially in terms of external complementary relations, increases an organization's power of influence among network members. That is because the “organization's field” (Scott, 1995) of influence or span of control is extended by increasing the number of complementary relations to network members. From institutional theory, Scott (1995) defines an organizational field with the following:

the notion of field connotes the existence of a community of organizations that partakes of a common meaning system and whose participants interact more frequently and fatefully with one another than those actors outside of the field. (Scott, 1995: 56)

Figure 1 J curve relationship expressed in terms of the S-P-D framework

In the presence of power and strong complementary relations, those interactions within such a field are based on a dependent relationship between the focal organization of power and its extended network of social members within its organizational field. Organizational power in conjunction with the strength of complementary relations creates more centralized network structures that are increasingly dependent on the resources of the focal organization. Therefore, expanding the organizational field enables the focal organization to derive enhanced positive network externalities or synergistic gains from a larger network structure. The organization's performance is therefore enhanced and a greater number of network members come under the influence of organizations that hold power. This is consistent with Giddens's “structuration theory” (Giddens, 1984). As Scott (1995) describes:

[In] Giddens's formulation, structure represents the persistent or more institutionalized aspect of behavior. Structures are both the result of past actions—social products—as well as the context or medium within which ongoing actions occurs. For its part, action operates to produce—to reproduce (perpetuate) or alter—structure. (Scott, 1995: 52)

Through the influence of organizational power whose control is extended by strong complementary relations, a focal organization “structures” the organizational field by rendering other organizations increasingly dependent on the complementary interactions imparted by this focal organization. The focal organization structures the actions and behavior of members in the organizational field to choose those resources that are complementary to the focal organization. This tends not only to reinforce the persistence of the complementary relations evoked by the focal organization, but also sustains its performance through synergistic network effects. That is, the complementary resources of organizational field members reinforce the performance of the focal organization and subsequently strengthen its power over field members. This can lead to the formation of a social identity consisting of complementary resource relationships and resource choices within the organizational field.

In addition, in further drawing from Giddens's (1984) structuration theory, organizational change within this organizational field is likely to be incremental. This is because structural processes tend to be persistent and are reinforced by the actions of individuals (Giddens, 1984; Scott, 1995). Hence, any radical change in resources initiated by organizational field members will deconstruct or destabilize the strength of the complementary relationships and power influences imparted by the focal organization. By virtue of organizational power, organizational field members are less able to exert such a destabilizing influence. In addition, any radical change initiated by either the focal or social network members will face inertial or path-dependent forces that arise from the development of network-based resource complementarities.

However, relative to members in this organizational field, the focal organization, by virtue of its power, is more likely to instigate radical rather than incremental changes. By initiating radical change, a single organization with power and strong complementary relations can create a “ripple effect” that can cause changes in resource use among organizational field members. This is reflective of the “sensitive-dependent” properties of complex systems in which individual influences can cause highly unstable system behavior (Marion, 1999; Stacey, 1995). It also follows Giddens's structuration argument. Even though the structure of complementary relationships is initiated by the focal organization and perpetuated by the actions of its organizational field members, the structure of these relationships can in turn be altered by the focal organization's power and its strong complementary relationships.

STRENGTH, POWER, AND DIVERSITY

An organization with diverse resources (D) coupled with strong resource complementarity (external orientation; S) and organizational power (P) strengthens the tendency for transitive networks. The presence of all three factors enhances performance and sustainability while also reducing the onset of radical change. In conjunction with the above argument of strength and power, increasing the organization's resource diversity amplifies the strength of its complementary relations and, thus, its field of power. This is because increasing an organization's resource diversity increases the potential number of complementary relations to its organizational field members. As new complementary relations can be formed, this increases the strength of the organization's complementary relations. In addition, as a greater degree of resource diversity can also create a greater number of resource-dependent relationships, this increases an organization's power.

Therefore, in coupling strength and power with organizational diversity, diversity has a reinforcing influence in so far as it extends the number of complementary relations and the organization's power to an expanded organizational field. As a result, such an effect enhances the organization's performance through a greater capitalization of externalities within this expanded network structure. In addition, since organizational diversity has an expansionary effect on the organizational field, this increases the likelihood that complementary relations will be transitive. Since transitive networks exhibit self-reinforcing complementary influences, this provides further performance-enhancing effects. This can yield the onset of increasing returns (Arthur, 1989) where positive feedback processes reinforce initial actions. In other words, with positive feedback the market tilts in favor of those organizations or products that get ahead (Arthur, 1989).

Hence, an organization with strong complementary relations, power, and diversity derives not only a greater capitalization of externalities from an expanded and transitive network structure, but, in capitalizing on these externalities, it sustains and reinforces these structural factors (S, P, and D) to yield self-reinforcing performance gains. This, however, can render an organization subject to lock-in (Arthur, 1989) behaviors that limit its flexibility to changing market and technology conditions. As a result, the organization is less likely to undertake radical change.

Moreover, as organizations in complex systems are subject to path-dependent/inertial influences (Arthur, 1989; Stacey, 1995), the combined influence of these three structural factors (S, P, and D) can yield the onset of lock-in behavior with respect to sustaining network performance. This sustainable performance is determined by the pattern of resources dictated by the transitive network. Network performance is highly sustainable because the complementarities found in this closed network structure contribute to self-reinforcing synergies. In addition, once network-based assets are developed and locked in, they are more difficult to replicate or imitate (Dyer & Singh, 1998). For reasons attributed to “causal ambiguity” (Barney, 1991), entrant organizations cannot reasonably determine those sets of assets or resources of a transitive network that yield sustainable performance gains. As a result, these network assets are more difficult to imitate and are less substitutable by entrant organizations.

As the combined influence of S-P-D is expected to generate increased and sustainable performance gains, organizations are less likely to initiate radical changes in behavior. Due to the stabilizing and self-reinforcing influences of transitive networks, this allows for the development of path-dependent and lock-in processes in which resources become increasingly cospecialized to members in the transitive network. This form of inter-asset specificity generates negative feedback tendencies in resisting radical changes. As a result, organizational diversity has a reinforcing influence on the strength of complementary relations and organizational power, by creating larger organizational fields that are more resilient to radical change than can be generated with organizational diversity alone.

POWER AND DIVERSITY

In the presence of power and diversity, the sustainability and performance of organizations are reduced relative to conditions where all three structural factors (S-P-D) are present. Power and diversity still afford a closed network structure in which performance gains are derived from the complementarities of the transitive network. However, in the presence of a limited number of complementary relations (i.e., weak complementary relations), the organization's field of influence is restricted to a smaller number of network members. As a result, the performance gains from transitive networks are reduced relative to conditions where all three factors are present.

In addition, relative to the presence of strength, power, and diversity, radical organizational change is more likely to occur. Organizations with power and diversity face fewer constraints imposed by a larger network structure. Smaller network structures are less “structurally embedded” than those containing larger memberships. Specifically, in the absence of strong complementary relations, changes in an organization's resources face fewer conflicting constraints than resources chosen by members within a smaller organizational field than that of a larger network. The absence of strong complementary relations reduces the occurrence of conflicting constraints, and therefore provides greater flexibility for organizations to conduct radical change.

Although with organizational diversity organizations have greater degrees of freedom to explore complementary combinations of resources. Even so, the presence of organizational power mitigates the extent of this radical organizational change. However, relative to the presence of strength, power, and diversity, power and diversity yield greater radical change.

STRENGTH AND DIVERSITY

In the presence of strong complementary relations (external) and organizational resource diversity, organizational performance is expected to be highly volatile and organizational change is expected to be radical. Under such conditions, the organizational field consists of a large number of social members where each is directly and indirectly related to the diversity of complementary resources held by organizational field members. In the absence of an ordering influence, such as organizational power, and due to the high interdependence of strong complementary relations, organizations within this organizational field are continually adjusting their resources so as to search and discover new complementary resource configurations.

Organizational diversity and the strength of complementary relations not only increase the space of permissible complementary configurations, but also render the resource choices of network members highly interdependent. Because organizations are confronted with a larger space of permissible complementary configurations, they are more likely to undertake the exploration and experimentation of these configurations so as to exploit undiscovered complementary relationships. Radical organizational change involving search in this greater space of complementary combinations is likely to occur. Moreover, due to strong complementary relations, such radical organizational change will affect the resource choices of other network members and is therefore likely to instigate radical changes in these organizations. With such radical organizational change, and given that the performance of members within an organizational field is highly interdependent, one therefore expects organizational performance to be highly volatile.

This behavior is consistent with the properties of NKCS fitness landscapes described by Levinthal (1997, 2002) and McKelvey (1999). As mentioned above, they argue that a highly interdependent or coupled system that contains a greater number of parts leads to chaotic behavior in which organizational change and performance are highly volatile and sensitive to the behavior of network members.

MANAGEMENT IMPLICATIONS AND DISCUSSION

The proposed S-P-D framework advances research in organizational change and performance in three key ways. First, it explicitly identifies performance with particular social network configurations. Social network theorists (Smelser & Swedberg, 1994) identify this as an area where further research needs to be conducted. Specifically, the concept of complementarity is incorporated into the social structural factors described by the S-P-D framework to explain organizational performance. This has performance implications for markets that are increasingly driven by network relationships, such as strategic alliances, joint ventures, partnerships, and clusters. In these markets, the S-P-D framework recognizes that an organization's performance cannot be driven by the productive potential of its internal resources, but its performance is also tied to the complementary relationships with external organizational members. Hence, this article extends other models of competitive advantage, such as the resource-based view, to contend that sources of competitive advantage reside in the structure of relationships described by the S-P-D approach.

Second, the S-P-D framework contends that the magnitude of organizational change is both amplified and tempered by the manner in which an organization is embedded within the structure of its social relationships. For instance, radical organizational changes are more likely to occur under conditions of strong complementary relationships and resource diversity. This, however, is contrary to the view held by some management practitioners and researchers, who find that radical change should be stimulated internally within a business. The S-P-D framework suggests that complementarity strength and, in particular, external complementary relations coupled with resource diversity should also be considered as additional factors affecting radical change.

Third, the proposed S-P-D framework not only contributes to research in organizational change and performance, but also can explain patterns of behavior in complex social systems. For instance, the sensitive dependent nature of a chaotic system can occur in conditions of strong resource complementarity and organizational diversity. Chaotic behavior is manifested in terms of increased volatility in organizational performance and increased occurrence of radical organizational change. On the other hand, the emergence of order in the form of transitive networks can occur in the presence of strong complementary relations, organizational power, and diversity. Both social structures can simultaneously occur to generate “edge of chaos” behavior. Market systems containing both chaotic and orderly social structures can yield organizational behavior that consists of incremental and radical organizational changes. Organizations at the edge of chaos will balance the efficiencies in exploiting complementarities conferred by the ordering influences of S-P-D organizational fields while at the same time incorporating those new explorations and experimentations conducted by S-P-D organizational fields.

However, in order to progress the application and testing of S-P-D relationships, an important area for future research requires the operationalization and measurement of complementarities. Although there has been significant growth in the operationalization and measurement of the structural dimensions of social networks—such as power, density, and diversity (see Burt, 1992)—social network research has seen limited incorporation of the complementarity construct into these structural dimensions. For instance, Dyer and Singh (1998) and Teece (2000) have underscored the importance of complementarities as a source of inter-organizational rent; in the fitness landscape models of Levinthal (1997, 2002), Levinthal and Warglien (1999), and McKelvey (1999), complementarities have been a central construct in their explanations of strategic change and performance. But as yet there has been limited discussion of the operationalization and measurement of complementarities within social networks.

This research proposes some tentative operational measures of complementarities for the S-P-D framework. Using the direct estimation of synergy approach of Davis and Thomas (1993), complementarities can be operationalized by the correlation or relatedness of the productive returns of resources held within and between organizations. Davis and Thomas (1993) utilize a concentric index to measure the synergies between the corporate assets of a multiproduct organization. An organization's market value and the value of its assets are used to estimate the synergies in this concentric index. An extension of this method to include synergies between the resources of different organizations can be used to measure the strength of (internal and external) complementary relationships. Moreover, a common measure of power used by social network researchers is centrality (Burt, 1992). This measure can be adjusted to account for the synergies estimated by Davis and Thomas (1993) and can then be used to operationalize the S-P-D's construct of power. The concept of diversity relates to the heterogeneity or diversity of resources found in the market place. Used as a measure of economic diversity, Shannon and Weaver's diversity index (1949) can be used to measure this construct of resource diversity.

However, future research should focus on elaborating on these tentative measures and developing appropriate estimation methods. In particular, the measurement and empirical methods conducted by Columbo and Mosconi (1995), Thomke and Kuemmerle (2002), and Whittington et al. (1999) may offer potential promise.

In addition, future applications of the S-P-D framework should also consider the use of agent-based modeling techniques. As agent-based models emphasize heterogeneous and nonlinear interactions of complex systems, it would provide a useful tool to develop further insight into the organizational change and performance relationships described by this research.

NOTES

The author would like to express his thanks for the helpful comments made by an anonymous referee of the Emergence journal and conference participants of the Managing the Complex IV conference in Fort Meyers, FL, 2003. This article is based on a paper presented at that conference and was originally titled “The complexity of social interactions: Organizational change and performance.”

- As interorganizational relationships are increasingly recognized by management scholars as an important but neglected area of investigation (Dyer & Singh, 1998), the arguments pertaining to the strength of complementary relations will emphasize external complementary relations, especially in relation to the concept of organizational power.

- As described later, the strength of complementary relations serves to increase this span of organizational control.

- This is of central importance to the Austrian economic debate on the equilibrium and disequilibrium tendencies of markets.

- This is analogous to arguments found in Kauffman's (1995) autocatalytic set theory, where the diversity of system elements positively influences the formation of autocatalytic or self-reinforcing chemical reactions.

- Incremental and radical change is expressed respectively as shorter and longer horizontal segments of this J curve relationship.

References

Arthur, W. Brian (1989) “Competing technologies, increasing returns, and lock-in by historical events,” Economic Journal, 99: 116-31.

Barney, J. (1991) “Firm resources and sustained competitive advantage,” Journal of Management, 17: 99-120.

Brown, S. & Eisenhardt, K. (1998) Competing on the Edge: Strategy as Structured Chaos, Boston, MA: Harvard Business School Press.

Burt, Ronald (1992) Structural Holes: The Social Structure of Competition, Cambridge, MA: Harvard University Press.

Columbo, M. & Mosconi, R. (1995) “Complementarity and cumulative learning effects in the early diffusion of multiple technologies,” Journal of Industrial Economics, 43(1): 13-48.

Cusumano, Michael, Mylonadis, Yiorgos, & Rosenbloom, Richard (1992) “Strategic manoeuvring and mass market dynamics: The triumph of VHS over Beta,” Business History Review, 66 (Spring): 51-94.

Davis, R & Thomas, L. G. (1993) “Direct estimation of synergy: A new approach to the diversity-performance debate,” Management Science, 39(11): 1334-46.

Dyer, J. & Singh, H. (1998) “The relational view: cooperative strategy and sources of inter- organizational competitive advantage,” Academy of Management Review, 23(4): 660-79.

Feld, S. (1981) “The focussed organization of social ties,” American Journal of Sociology, 86(5): 1015-35.

Garud, R. & Van De Ven, A. (2002) “Strategic change processes,” in A. Pettigrew, T. Howard, & R. Whittington (eds) Handbook of Strategy and Management, London: Sage: 206-32.

Giddens, A. (1984) The Constitution of Society, Berkeley, CA: University of California Press.

Granovetter, Mark (1983) “The strength of weak ties: A network theory revisited,” Sociological Theory, 1: 201-33.

Jantsch, E. (1980) The Self-Organizing Universe: Scientific and Human Implications of the Emerging Paradigm of Evolution, New York: Pergamon Press.

Kauffman, S. A. (1995) At Home in the Universe: The Search for Laws of Self-Organization and Complexity, New York: Oxford University Press.

Kalaitzandonakes, N. & Bjornson, B. (1997) “Vertical and horizontal coordination in the agro-biotechnology industry: evidence and implications,” Journal of Agricultural and Applied Economics, 29(1): 129-39.

Lachmann, L. (1947), “Complementarity and substitution in the theory of capital,” Economica, 14(54): 108-19.

Lachmann, L. M. (1977) Capital, Expectations, and the Market Process: Essays on the Theory of the Market Economy, Kansas City: Sheed Andrews and McMeel.

Levinthal, D. A. (1997) “Adaptation on rugged landscapes,” Management Science, 43(7): 934-51.

Levinthal, D. A. (2002) “Organizational capabilities in complex worlds,” in G. Dosi, R. R. Nelson, & S. G. Winter (eds) The Nature and Dynamics of Organizational Capabilities, New York: Oxford University Press: 363-81.

Levinthal, D. A. & Warglien, M. (1999) “Landscape: Design for local action in complex worlds,” Organizational Science, 10(3): 342-57.

Marion, R. (1999) The Edge of Organization: Chaos and Complexity Theories of Formal Social Systems, Thousand Oaks, CA: Sage.

Matsuyama, K. (1995) “Complementarities and cumulative processes in models of monopolistic competition,” Journal of Economic Literature, 33(2): 701-29.

McKelvey, Bill (1999) “Avoiding complexity catastrophe in co-evolutionary pockets: Strategies for rugged landscapes,” Organizational Science, 10(3): 294-321.

Nahapiet, J. & Ghoshal, S. (1998) “Social capital, intellectual capital and the organizational advantage,” Academy of Management Review, 23(2): 242-66.

Pfeffer, J. & Salancik, G. (1978) The External Control of Organizations: A Resource Dependence Perspective, New York: Harper & Row.

Powell, W. W., Koput, K.W., & Smith-Doerr, L. (1996) “Interorganizational collaboration and the locus of innovation: networks of learning in biotechnology,” Administrative Science Quarterly, 41(1): 116-45.

Rosenhead, J. (2001) “Complexity theory and management practice,” Human Nature Review, http://human-nature.com/science-as-culture/rosenhead.html.

Scott, R. W. (1995) Institutions and Organizations, Thousand Oaks, CA: Sage.

Shannon, C. E. & Weaver, W. (1949) The Mathematical Theory of Communication, Urbana, IL: University of Illinois Press.

Smelser, Neil J. & Swedberg, Richard (1994) “The sociological perspective on the economy,” in Neil J. Smelser & Richard Swedberg (eds) The Handbook of Economic Sociology, Princeton, NJ: Princeton University Press: 3-26.

Stacey, R. D. (1995) “The science of complexity: An alternative perspective for strategic change,” Strategic Management Journal, 16: 477-95.

Teece, D. J. (2000) Managing Intellectual Capital: Organizational, Strategic, and Policy Dimensions, New York: Oxford University Press.

Teng, Bing-Sheng & Cummings, Jeffrey (2002) “Trade-offs in managing resources and capabilities,” Academy of Management Executive, 16(2): 81-92.

Thomke, S. & Kuemmerle, W. (2002) “Asset accumulation, interdependence and technological change: Evidence from pharmaceutical drug discovery,” Strategic Management Journal, 23: 619-35.

Thompson, James (1967) Organizations in Actions: Social Science Bases of Administrative Theory, New York: Mc Graw Hill.

Whittington, Richard, Pettigrew, Andrew, Peck, Simon, Fenton, Evelyn, Conyon, Martin (1999) “Change and complementarities in the new competitive landscape: A European panel study, 1992-1996,” Organization Science, 10(5): 583-600.