An Integrated Model for Strategic Management in Dynamic Industries:

Qualitative Research from Taiwan's Passive-Component Industry

Stephen Tsai

National Sun Yat-sen University, TWN

Chiang Hong-quei

National Sun Yat-sen University, TWN

Scott Valentine

National Sun Yat-sen University, TWN

Introduction

For the past few decades, strategic management theorists and practitioners alike have been absorbed with the pursuit of answers to a single question: Why do some firms perform better than others? Until the late 1980s, the search for answers to this question was centered on research that revolved around two major strategic thinking paradigms: an industrial organizational perspective (IO school), and a resource-based view (RBV school). Essentially, the IO school of thought emphasizes strategy formulation based on policies directed at controlling the market (Porter, 1980, 1991). On the other hand, the RBV school of thought is fundamentally concerned with improving corporate performance through efficiency (Wenerfelt, 1984; Barney, 1991). In short, one school is outwardly focused and one school is inwardly focused.

During the 1990s, in the face of increasing market uncertainty and rapid market change fueled by globalization and the rapid evolution of technology, concerns proliferated over the ineffectiveness of both the IO and RBV schools for guiding strategy in dynamically evolving industries. In response to this, stirrings of a new perspective on strategic thinking became evident in many strategic management journals in the late 1990s (Beinhocker, 1997, 1999; Anderson, 1999; Wood, 1999). The new perspective, which we will refer to as the complex adaptive systems perspective (CAS school), emphasizes the need to balance structure and flexibility in order to implement strategy successfully in dynamic markets (Brown & Eisenhardt, 1997, 1998).

The initial intent of this article was to apply qualitative grounded-theory research into Taiwan's dynamically evolving passive-component industry to guide the formulation of a workable strategic model based on the new CAS school. However, our findings clearly revealed that the strategic challenges confronting managers in this dynamic industry were multivariate and could be best described by a strategic model that integrates the three schools of strategic perspective.

Accordingly, this article seeks to contribute to the evolving body of knowledge for strategic management in dynamically evolving industries by introducing an conceptual framework constructed from grounded theory, which outlines how key perspectives from the IO, RBV, and CAS schools can be integrated in order to help managers conceptualize the strategic management function.

EVOLVING STRATEGIC THINKING

Over the past 10 years, CAS theory has become a fixture in strategic management circles because of its purported effectiveness at guiding strategy in dynamic industries where the landscape is changing and unpredictable (Wood, 1999; Venkatraman & Subramaniam, 2002). In fact, even mature companies in predictable industries such as retailing are finding their market superiority challenged by new entrants that are rapidly changing the competitive landscape (Peters, 1988).

Brown and Eisenhardt (1998) have produced extensive research on how applied CAS principles can be used to compete successfully in a variety of traditional and nontraditional industries. Their case study findings strongly support the claim that CAS-based strategic concepts such as coadaptation, regeneration, time pacing, improvisation, and experimentation are essential concepts in producing a forward-thinking sustainable market strategy.

However, the trends of current research do not necessarily imply that IO and RBV schools of strategic thought are hereby rendered impotent for strategy formulation. IO and RBV perspectives have demonstrated proven effectiveness in guiding strategy when there is a clearer idea of what the future has in store (Cool et al., 2002). This implies that there are still applications on two levels. First, not all industries are evolving at a breakneck pace and not all industry segments exhibit rapidly evolving products. Accordingly, traditional strategic perspectives may still have a role in short- to medium-term planning for stable industries. Second, there are still predictable short-term horizons in many dynamic industries that can benefit from a focused external analysis of the market (as advanced by IO theory) and a controlled strategic approach to building competitive advantage through the development of resource advantage (as advanced by RBV theory).

STRATEGIC MANAGEMENT IN TAIWAN'S PASSIVE-COMPONENT INDUSTRY

In the early 1990s, many corporate strategists in Taiwan's passive-component sector who were schooled in IO and RBV perspectives began to realize that a paradigm shift was necessary in order to cope effectively with strategy formulation in dynamically evolving, unpredictable markets. In short, strategists in this sector began to adopt new strategies to guide their thinking in areas where IO and RBV perspectives were not effective.

Accordingly, the authors of this article contend that Taiwan's passive-component industry, which produces passive components for many electrical devices, represents a manageable microcosm for evaluating the strategic challenges that firms in dynamically evolving industries face. Culture issues notwithstanding, it is contended that a model that can effectively guide strategy formulation in this industry is worthy of consideration for global application. Table 1, which summarizes the industry's development over the past 50 years, serves to highlight a common characteristic of many dynamically evolving industries: gradual intensification of product differentiation efforts as competitors enter the market and as technology allows for broader applications.

During the stage of emergent complexity, strategists in the passive-component industry were confronted with planning challenges unlike any faced by strategists of prior eras. For perhaps the first time in recorded history, the complexity of the evolving business market began to eclipse the ability of strategists to develop models to plan effectively for the future. It was at this stage that our research began.

| Fledgling manufacturing stage • 1950-1980. • 70% of the Taiwanese passive-components makers categorized as small and medium enterprises. • Product features: Traditional socket-type components (neither capital nor technologically intensive). • Competitive advantage: Cost and production efficiency. |

| Technical evolution stage • 1980-late 1990s. • Taiwanese government 10-year development program in support of electronics and IT industries. • Emboldened by strong demand in the passive-component industry, many makers took advantage of the benefits provided through the program and invested heavily in automated production facilities. The result was broad-scale improvement in economies of scale and scope. • Product features: Increased complexity of design (surface mounting technology), shorter lifecycles, and falling prices. • Competitive advantage: Differentiation, technology capabilities. |

| Stage of emergent complexity • Starting late 1990s-present. • Boom in the telecommunications industry creates boom in passive-component industry. • Strategic alliances, mergers, and acquisitions were commonplace during this period as companies vied for larger market share, which would facilitate the economies of scale necessary to simultaneously innovate while competing on a low-price basis. • Product features: Miniaturization, increased specialization, and falling prices. • Competitive advantage: Differentiation, technology capabilities, fast turnaround time, strategic alliances, mergers. |

Source: Electronic Industry Yearbooks, 1973–1998, Taipei: Taiwan Institute of Economic Research; Electronic Components Industry Yearbooks, 1999–2001, Taiwan: Industrial Technology Intelligence Service, Industrial Technology Research Institute.

Table 1 Evolution of Taiwan’s passive-component industry

RESEARCH METHODOLOGY

A grounded-theory-building approach was adopted in order to develop a framework for strategic thinking that adhered directly to findings in the case study. It was felt that research driven from a theory-based perspective would bias the results by injecting unnecessary levels of researcher bias (Strauss & Corbin, 1990). Accordingly, the findings presented in the next section avoid reference to existing theory. The analysis section that follows then applies existing IO, RBV, and CAS concepts to the emergent framework.

The research was carried out over a three-year period to allow us to follow strategic developments as the industry evolved and as the fortunes of the companies under study fluctuated in response to strategic decisions. For simplicity of perspective, the research can be conceptualized in three stages: benchmarking, generative, and confirmation.

The benchmarking stage involved both secondary and primary research efforts. After a background study to understand the development of the industry, extensive open-structure interviews were undertaken with senior executives and strategists from 10 different passive-component makers in Taiwan. Interviews were only loosely structured to allow the subjects to discuss freely the strategic challenges facing their firms. It was felt that by allowing strategists such flexibility in interviews, the main strategic issues could be uncovered without introducing interviewer bias. This was an iterative process that in many cases resulted in multiple interviews. This stage extended from August 1998 to December 2000.

During the generative stage, developments in the industry and the relative performance of the firms to which our research subjects were associated were tracked over a one-year period to evaluate the effectiveness of the strategic decisions implemented by our subjects. During this year, the strategic initiatives employed by various managers were evaluated with input from 25 senior managers from Phillips and Yageo, who provided feedback regarding the applicability of the emergent concepts in helping to guide strategic thinking effectively. This gave us the direction needed to create an initial draft of a strategic framework for guiding decision making in dynamically evolving industries. It also allowed us partially to validate practitioner acceptance of our model as a workable framework. This stage lasted until the end of 2001.

During the confirmation stage of the research process, a framework for guiding strategic decisions was beginning to emerge. To further validate the concepts of this emergent framework, more in-depth interviews were conducted to ascertain practitioner acceptance. Accordingly, the framework outlined in this article has been vetted by practitioners over two stages of the research.

In the following section, the main findings of the research are presented systematically with a focus on five macro-strategic challenges, which constitute a collective of core challenges faced by managers as a result of change in their industry. The findings will later be integrated into a strategic model that will be introduced in the implications section.

FINDINGS

CLEAR OBJECTIVES WITH DIFFERENT TIME HORIZONS

Strategists who took part in the interviews shared a holistic strategic belief that profitability and innovation represent an interlinked tandem for success. One manager aptly expressed the general consensus of those interviewed:

Increasing performance standards and progressive miniaturization are ongoing trends that coexist with downward pressure on prices. Therefore, the challenges of maximizing innovation and profitability are inseparable; they must be addressed concurrently.

Furthermore, managers were in agreement that there are three general strategic objectives that were associated with traditional strategic time horizons (short, medium, and long term). These objectives are maximizing profitability to raise short-term cash to finance investment and R&D; directing investment and R&D efforts to ensure that current core competencies were exploited for medium-term profitability; and facilitating long-term investment and exploratory R&D efforts directed at technologically reinventing a firm's market landscape in the long run.

Rapid environmental change, which adds complexity to the strategic management process, was identified as the main complicating factor in trying to balance these three objectives strategically. Accordingly, one strategic challenge with which all managers were concerned was either to anticipate change successfully or, in cases where prediction was not possible, to react faster than competitors to change.

ENVIRONMENTAL CHANGE AGENTS

Three environmental change agents emerged as major influencers on the strategic management process: the fractured evolution of technology; the migration of production overseas; and the overall rapid pace of unpredictable change. The “macro-strategic” challenges that these change agents spawn are outlined in the next three paragraphs.

Technological developments in the consumer electronics, computer, and communication (3C) industries introduce a further degree of complexity to product planning. One manager who was interviewed effectively summed up the depth and breadth of change: “Many of today's customer-service and technology solutions were unimaginable a decade ago.” Advantageously, such rapid technological advancement enables firms to innovate to address highly specialized consumer demand. However, such change also gives rise to two macro-strategic challenges: how to finance R&D initiatives when core product profitability is declining; and how to direct investment and R&D efforts in an unpredictable technological landscape.

The second environmental change agent, migration of production overseas, which is caused by a quest for cheaper factor inputs and faster service, also creates two macro-strategic challenges: how to integrate geographically dispersed operations effectively; and how to manage alliances with potential competitors.

Finally, the third environmental change agent, the overall rapid pace of unpredictable change, presents a holistic macro-strategic challenge of trying to stay ahead of the competition through effective information management.

FROM ENVIRONMENTAL CHANGE AGENTS TO MACRO-STRATEGIC CHALLENGES

In collating our research findings, we found that using the term “macro-strategic” challenge was useful for classifying the types of strategic challenges that occupy the attention of the strategists in Taiwan's passive-component industry. Accordingly, the results of the research will be presented under five macro-strategic headings: financing innovation amid declining profitability; directing investment and innovation in an ever-changing landscape; integrating geographically dispersed operations; managing alliances with potential competitors; and managing knowledge for competitive advantage.

Financing innovation amid declining profitability

In the 3C industries, rapid growth over the past two decades in terms of sales volume and product diversity has had a direct and significant influence on the passive-component industry. From a positive perspective, growth in the 3C industry has led to heavy demand in passive components. Therefore, during the technical evolution stage of Taiwan's passive-component industry (Table 1), many Taiwanese companies were able to expand production and benefit from economies of scale and scope. However, from an adverse perspective, as the industry moved into the stage of emergent complexity, the demand for specialized products began to eat into the profits that were generated by mass production. One veteran manager who was interviewed summed up the situation as follows:

Productivity—ever improved by process technology—results in reduced costs and prices. This leads to a profitable component industry, and hence acts as a catalyst for component sales growth. However, as the business grows, differentiating forces become stronger and component makers have no choice but to navigate the twists and turns along the route to differentiation.

Accordingly, the macro-strategic challenge for passive-component strategists as a result of the environmental change toward specialization is financial: how to amass the resources necessary to finance innovation in a business environment of declining profits driven by a demand for specialized products and increased competition.

Strategists included in the validation studies were unanimous that a chief cog in the drive for profitability lay in robust cost-control efforts. As one manager explained:

Price competition is rigorous and relentless, and cost reduction is the determinant of survival. We permanently embed the concepts of cost control and efficiency into our corporate culture. And we monitor our progress through benchmark comparisons between our global business units. [To give you an example of the results of these efforts] in 2001, the average price of chip resisters declined by 30 percent due to global overcapacity; however, we still kept a positive margin by reducing the cost of production by 40 percent.

Although cost-control efforts were well-voiced concerns, many managers also emphasized the need to invest in innovative efforts to develop new products, which would allow the firm to separate itself from the competition in order to ensure both sustainable success and higher profit margins.

Directing innovation in an ever-changing landscape

Although a successful financial strategy is necessary for amassing the funds required for long-term sustainability, the challenge of predicting the future direction of change and creating an operational environment that encourages such innovation represents the highest priority in the strategic initiatives of many of our subjects. Findings indicate that there is both a reactive perspective and a proactive perspective to such strategy formulation.

From a reactive perspective, many managers stressed the importance of encouraging operational flexibility. In order to stay ahead of the competition through new product development, many strategists described chaotic environments in which investment, R&D, sales, and production were integrated at breakneck speed. One manager from Taiwan's leading passive-component maker, Yageo, described the process thus:

To meet the requirements of a new product order, we immediately procured the related equipments and materials; simultaneously carried out financial investment and technological transfer; refocused R&D to ensure quality integration, ramped up manufacturing, and dispatched sales personnel to speed the new product onto the market. Under the substantial pressure of ever-present deadlines, the project leader was constantly on edge, like a baseball coach waiting for his player to steal base.

From a proactive perspective, findings revealed the existence of a high degree of sensitivity concerning the risks associated with investment and R&D efforts. Specifically, in a market when the technology base on which the investment and R&D effort is focused may be unexpectedly rendered obsolete by new technology, strategists proactively seek out tools that will allow them to reduce the risk. One of the strategic solutions to reducing risk is the management of information. One manager explained:

The advantages of niche markets won't last long and the margins can be expected to diminish over time. We are always prepared for the next downturn caused by evolving technology. To handle prescient risk, we strive to create a nimble information network, which includes material and equipment suppliers, customers, and partners around the world… to share information on markets… to find a better roadmap.

In addition to becoming better informed in order to increase the accuracy of strategic decisions, it is clear from our research that developing support systems that encourage people to innovate is a related strategic concern. One manager related his firm's strategy for encouraging ownership:

Stock compensation and the inclusion of stock options have been an increasingly important feature of our compensation strategy in order to promote a sense of ownership in our people and to entice talent from other makers into our fold.

Furthermore, it was discovered that many strategists in the passive-component industry encourage innovation that extends beyond simple product extension in order to encourage the development of new technologies that will allow their firms to stay on the edge of the technology curve. The R&D manager of a leading passive-component supplier explained:

No single technology will be optimal for all our future needs. For instance, thin-film technology is currently effective for radio frequency (RF) modules, but for digital-type modules new technology is needed. We need to align our strategy with the co-evolution of the market, technology, and alliances.

In summary, in order to perpetuate success in an ever-changing landscape, strategists in the passive-component industry exhibit both reactive and proactive responses. From a reactive perspective, the focus is on instilling the firm with the flexibility necessary to compete effectively in the short term. From a proactive perspective, the focus is on directing innovative efforts through the use of up-to-date information in a broad spectrum of areas in order to diversify risk; and on facilitating innovation through mechanisms that promote creative thinking.

Although preparing a firm to respond effectively to rapid technological change is a priority for strategists in the passive-component industry, adjusting to the ongoing globalization of business concerns was found to occupy a high degree of strategic planning time.

Integrating geographically dispersed operations

Three factors have combined to force Taiwanese passive-component firms to separate manufacturing operations: rising factor costs, industrial land shortage, and the need to co-locate with supply chain members. First, increasing labor and resource costs in Taiwan make it no longer feasible for low-end products to be produced competitively there. Accordingly, many Taiwanese passive-component makers now have extensive operations in developing countries around the region, such as Thailand and mainland China. In contrast, many high-end products are still manufactured in Taiwan in order to take advantage of the design expertise available there. Second, a shortage of industrial land close to labor markets in Taiwan's densely populated northern and northwestern regions forces expanding firms to search elsewhere for plant space. Frequently this search encompasses site evaluation in mainland China. Third, as electronic manufacturers relocate to cheaper labor markets, pressure is put on Taiwanese passive-component makers to co-locate in order to facilitate faster service.

Of particular relevance are the industrial parks that are springing up throughout mainland China, which are attracting an ever-increasing number of Taiwanese passive-component manufacturers. As a major Taiwanese supplier summarized:

The largest growth market for electronic products is China, where the end products are being assembled. Passive-component suppliers must be close to the customer to ensure the lowest cost and provide the highest level of serviceability. Naturally, we build fabricating plants or warehouses in other areas where production is comparatively competitive, such as Mexico and Eastern Europe. However, the focus is on China.

The phenomenon of labor-intensive manufacturing industries moving to markets where land and labor are cheap is not new in high-tech fields. Business migration was experienced in an earlier wave in the 1970s when transistor manufacturing operations began to move from countries such as Japan and Hong Kong to less-developed Asian regions such as Malaysia, Thailand, Korea, and mainland China (Liu, 2001). However, what is different from that migration is that in today's production climate, manufacturing operations are highly fractured. Plants that produce specific components are being established next to component assemblers. This means that for larger passive-component makers that manufacture a wide array of components for many different customers, manufacturing plants are scattered throughout the region. The result is that strategists are not merely faced with integration challenges associated with one or two large overseas factories; they are faced with the integration challenges posed by a large number of smaller factories in a diverse array of countries. As one strategist related:

With distribution growing worldwide, we can no longer afford to support the sales effort by ourselves. We must rely on strategic alliances that further complicate an already complex industry.

In addition to logistical problems, the migration of firms within the 3C industries into geographically dispersed, specialized production zones poses an additional series of strategic challenges that relate to the management of alliances.

Managing alliances with potential competitors

The fourth macro-strategic challenge facing passive-component strategists relates to the need to collaborate closely with firms that in other product markets are competitors. Coopetition is the name commonly given to describe this phenomenon (Gnyawali & Madhavan, 2001). Success depends on careful control of timing, quality, and quantity of information shared.

Passive-component manufacturers seek carefully to maintain a balance between integrating information to cooperate effectively on supply chain projects while also trying to protect proprietary knowledge that may be used by the project partner to compete against the firm in other markets. One manager described his firm's efforts in this regard:

When undertaking alliances we seek to reach agreement with the partner on how to mutually protect our core competencies. Usually a specific individual or department on both sides is appointed to such a role. However, this does not always prevent employees from jumping ship and taking their knowledge with them.

Findings indicate that the strategic challenge is further amplified in the passive-component industry because even with security controls in place, collaborative relationships speed up technology transfer. One manager describes how a strategic alliance gave rise to a competitor:

In the past, we had a small supply chain ally to which we assigned simple assembly tasks. However, to meet increasing market demands the complexity of the jobs undertaken increased. Therefore, the necessity to disseminate advanced technical knowledge also increased. In the end they wound up displacing our firm's role in the supply chain.

In summary, findings are clear that the need for cooperation places enormous strategic demands on managers in the passive-component industry. They must balance the need to communicate with other parties in the supply chain to ensure effectively integrated supply lines with the need to protect information that may undermine the firm's competitive position in other areas. While managing this complex process, strategists also must contend with the threat that cooperation with a potential competitor may allow that project-based ally to acquire either the technical competencies or the production proficiencies to become a serious competitor in other areas.

Managing knowledge for competitive advantage

The final macro-strategic challenge relates to an issue that seems to be pervasive in all areas of strategy: how to manage knowledge for competitive advantage.

In the passive-component industry where market and technological changes occur rapidly, strategists take great strides to ensure that they are kept up to date. A senior executive outlined his extensive information network:

I organize a collection of information sources to get a feel for the market every day. I talk to suppliers about where they see the market; I have regular conference calls with all our people in the field; and I interview over 50 supply chain executives each month to get information on inventory, lead-times and expectations for the next month's sales.

Amid the ever-escalating investment demands of the passive-component industry, there is a specific strategic need to amass knowledge that will facilitate effective decisions regarding R&D investment, capital plant expenditures, and strategic alliances. Findings indicate that strategists are particularly concerned with two areas of knowledge management: achieving supply chain consensus on R&D direction; and unifying information management systems.

Regarding R&D initiatives, findings indicate that strategists frequently strive to enlist the cooperation of supply chain partners and customers. Research demonstrates that in addition to the financial and experiential benefits derived from collaboration, achieving a collaborative commitment also provides firms with a sense of security. Through collaboration, a supply chain member can be assured that at least to a certain extent, the supply chain evolution and thus technical evolution will continue in a predictable direction. An R&D manager explained this process:

R&D projects for existing supply chain products should be initiated and codesigned with the major OEM or EMS customers. Tomorrow's components and modules will incorporate more value-added, and this new challenge must also be met through collaboration if our firm is to remain part of the supply chain.

Research indicates that many firms are also struggling with the operational challenges of trying to integrate diverse knowledge management systems that were inherited with the many acquisitions that occurred in the past decade. As one strategist noted:

Part of the problem is that internal IT operations at many OEM companies have been developed in a piecemeal fashion or part of a patchwork quilt that came along with acquisitions. Therefore, managing data is difficult.

Many strategists find knowledge management to be an important cog in reducing the risks associated with predicting trends in such a dynamic industry. This is true whether this involves integrative efforts with partners and customers, or systems integration to ensure that all parts of the network have access to up-to-date decision-support and modeling systems.

IMPLICATIONS

The need for effective insight into strategy was a common theme woven through our research. Accordingly, perhaps the most surprising discovery from the research was that the vast majority of managers revealed that they had no concrete framework (structure) with which to guide their strategic decisions. One manager was forthright about this:

We found frequently that our initial strategic aims were not hitting the moving target. Often halfway through a strategic implementation we found it necessary to make adjustments that were often based on judgment and applied experience.

Additionally, in discussions on strategy most managers displayed a propensity to equate strategy with IO/RBV schools. Few were aware that a CAS perspective existed that allowed them to consider strategy in a complex environment. However, despite the lack of up-to-date strategic understanding, many managers were intuitively aware of their strategic deficiencies in the aftermath of failure. One manager who was schooled in traditional strategy touched on the need for a new strategic perspective when discussing the reasons for his firm's bankruptcy:

In hindsight, I now realize that myopic vision concerning the future evolution of the industry was at the heart of my firm's downfall. I did not make the innovative commitments necessary to prepare my firm to compete in the midst of technological upheaval.

Notwithstanding the willingness to admit culpability, the vast majority of managers alluded to the need for a framework that would help them conceptualize their strategic challenges. Accordingly, the next section outlines the development of such a framework through a two-step process.

INTEGRATING THE FINDINGS: CONNECTING THE FIVE MACRO-STRATEGIC CHALLENGES

In the findings section, the key strategic challenges in Taiwan's passive-component industry were described by classifying the challenges into five macro-strategic challenges, summarized in Table 2.

A time element governs the desired outcomes of these five macro-strategic challenges. For example, strategies that focus on the need to maximize profitability require sustained short-term focus. On the other hand, strategies that focus on developing alliance strategies and relocation strategies in order to exploit core competencies focus on longer-term outcome objectives. At the extreme, the strategic initiation of projects designed to reform a technological landscape are often extended long-term R&D projects that require revision as technology evolves and the technological landscape changes.

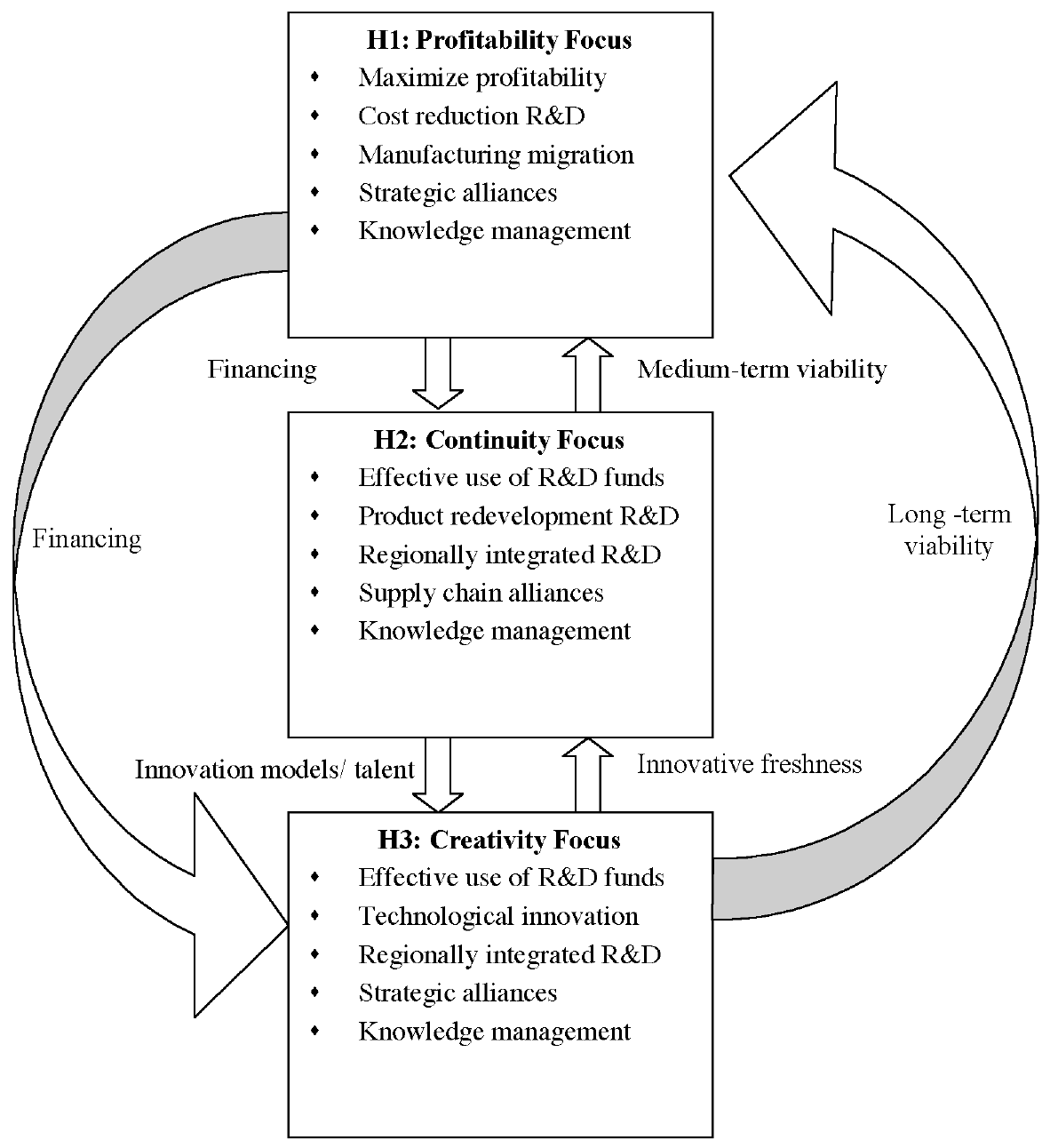

Unsurprisingly, our research confirms that strategists, on a daily basis, address strategic initiatives that span the range of outcome objectives from short-term profitability goals to longer-term product-development goals. Accordingly, a framework that attempts to conceptualize the five macro-strategic challenges should do so while recognizing the time element that governs the outcome of such decisions. We have done so in the model represented in Figure 1 by separating all strategic decisions into three time-based outcome frames: short term (profitability), medium term (core competency extension), and long term (technological innovation). In this section we explain the elements of the framework represented in Figure 1.

| Financing innovation amid declining profitability Strategic issues concern increasing profitability. Strategy revolves around R&D for cost control, product-mix decisions, relocating plants to lower input costs, and the creation of strategic alliances based on competitive cost advantages. |

| Directing innovation in an ever-changing landscape Strategic issues relate to ensuring the structural flexibility and the support systems necessary to facilitate innovation. Strategy revolves around R&D initiatives to lower costs, extend existing product lines, and develop new technology to stay ahead of the competitive technology curve. |

| Integrating geographically dispersed operations Strategic issues focus on ensuring that decentralized operations maximize efficiency. Strategy revolves around knowledge management, intercultural communication, and overall strategic integration of operations. |

| Managing alliances with potential competitors Strategic issues concern protecting proprietary knowledge while working with other firms. Strategy revolves around knowledge management, shared R&D for cost saving and innovation, and collaborative production efforts based on core production competencies. |

| Managing knowledge for competitive advantage Strategic issues relate to filtering an increasing amount of information and coordinating knowledge management systems for effective decision support. Strategy revolves around the development and integration of knowledge management systems. |

Table 2 Summarizing the five macro-strategic challenges

The core of the framework introduced in Figure 1 rests with the three boxes in the center. These represent the three time-based outcome perspectives (represented by horizons H1, H2, and H3) that govern strategic management initiatives. Interviews with strategic managers qualitatively validated our contention that these three planning horizons illustrate the self-sustainable cycle of business. Profitability from current products (H1 outputs) finances core competency extension (H2 activities) and longterm technical innovation (H3 activities). Successful strategy that is implemented at H2 and H3 levels results in the development of new products that become the profitable products of the future.

In order to highlight the holistic nature of strategic management, the arrows flowing out of and into the boxes in the model in Figure 1 represent important input and output flows (identified from our research) exchanged among the strategic horizons. The findings as represented by this model clarify a key conclusion of our research, that strategic managers must simultaneously balance strategic planning over all three horizons in order to construct a holistic strategy for sustainable success.

Figure 1. The integrated strategic planning framework for dynamic industries

In this section, we elaborate on this framework by reviewing the main strategic issues that confront managers in each of the three strategic planning horizons. We will also describe the outputs and inputs of each horizon in order to identify how the framework is inseparably linked.

Horizon 1: Profitability focus

The box labeled “H1: Profitability Focus” represents all of the short-term strategic decisions that managers need to make in order to ensure that a firm generates the profits necessary to invest and innovate. The first of the five macro-strategic challenges identified in the research (financing innovation amid declining profitability) fits clearly into this short-term realm. In pursuit of a strategy to maximize profitability, macro-strategy issues include making use of strategic alliances to reduce production and distribution costs; considering the effective relocation of manufacturing facilities to ensure that factor inputs are minimized; and guiding cost-reduction R&D efforts.

In terms of conceptual integration, there is one prime output and two significant inputs from H1 initiatives that are exchanged with H2 and H3 initiatives. The key output emerging from H1 strategy (as represented by the arrows) is cash to finance innovation and growth. On the other hand, the main inputs to H1 from H2/H3 activities are of a conceptual nature: Successful strategy implemented over H2 and H3 time horizons results in the development of products that become the H1 profit centers of the future.

Horizon 2: Continuity focus

In the middle box labeled “H2: Continuity Focus,” the strategic focus is on product reengineering and feature extensions in order to ensure that the company draws on current competencies to produce a line of profitable products in the medium term (H2). New variations on existing products capitalize on existing demand and existing technology over a timespan that is predictably stable. However, it is significant to note that in the passive-component industry, we found that this H2 timespan was in fact relatively short because technology was evolving rapidly and unpredictably. Macro-strategic decisions in the H2 realm focus on facilitating innovation through implementing systems and structures to allow engineers to innovate to extend product life; creating strategic alliances with supply chain members to improve current product lines; relocating R&D facilities to be closer to the customer; and integrating globally dispersed operations to share R&D initiatives.

Our research indicates that there are two key H2 outputs that benefit H1/H3 activities. First and foremost, new products become the H1 products of the future. Second, the structures, policies, and people necessary for success in the innovative process constitute a resource base from which H3 strategic initiatives can draw.

In terms of inputs, as mentioned earlier, H2 activities are sustained through H1 profitability. Additionally, concepts developed through highly creative H3 activities can be transferred to H2 activities to infuse the innovation process with fresh perspective.

Horizon 3: Creativity focus

The bottom box labeled “H3: Creativity Focus” represents all the macro-strategic decisions encountered in the pursuit of defining vision and leadership to allow the company to anticipate (or better yet, initiate) technological change.

As was the case for the other two horizons, successful strategic initiatives in the H3 strategic horizon also produce outputs that represent inputs to the other two strategic horizons. The prime output in H3 initiatives is new product development based on evolving technology. This ensures the long-term survival of the firm. Innovations in the H3 creative process are also important inputs to the H2 creative process, because H3 activities produce important creative insights into the innovation process.

The H3 strategic horizon also relies on two important inputs from the other two horizons. First, the profits from H1 strategic initiatives are essential for sustaining H3 creative efforts. Second, the innovative systems and know-how that are by-products of product redevelopment R&D initiatives (continuity focus) are often transferable for longer-term innovative efforts.

LINKING HORIZONS AND MACRO-STRATEGY

As can be inferred from our model (Figure 1), with the exception of financing innovation amid declining profitability, the five macro-strategic challenges that were suitable for grouping the research findings cannot be smoothly integrated into a model that recognizes the importance of time-bounded decision making. This reflects our findings that strategic decisions occur daily over all three time horizons and involve initiatives that are in many respects inseparable. This implies that the daily decisions that managers make in respect to strategy on multifaceted decisions related to issues such as R&D, production location, strategic alliances, and knowledge management all have the potential to affect outcomes in the three horizons. In short, managers must recognize that decisions made to have a positive impact on one strategic horizon will also likely affect initiatives in the other two horizons. Accordingly, the challenge for strategists is to find an acceptable balance between maximizing profitability; facilitating product redevelopment; and encouraging long-reaching technical innovative efforts. We have summarized these overlapping macro-strategic challenges in Table 3.

| Horizon | Macro-strategic challenge |

|---|---|

| Horizon 1: Profitability | Financing innovation amid declining profitability Integrating geographically dispersed operations Managing alliances with potential competitors Managing knowledge for competitive advantage |

| Horizon 2: Continuity | Directing innovation in an ever-changing landscape Integrating geographically dispersed operations Managing alliances with potential competitors Managing knowledge for competitive advantage |

| Horizon 3: Creativity | Directing innovation in an ever-changing landscape Integrating geographically dispersed operations Managing alliances with potential competitors Managing knowledge for competitive advantage |

Table 3 Macro-strategic challenges

RELATIONSHIP BETWEEN OUR FRAMEWORK AND EXISTING STRATEGIC THEORY

It is our contention that the findings of our qualitative research argue for a revision of the perceived relationships among existing strategic management schools. Rather than IO, RBV, and CAS schools being considered mutually exclusive approaches to strategic management (Beinhocker, 1997; Lengnick-Hall & Wolff, 1999), our research indicates that managers in dynamically evolving industries face daily strategic challenges that require the application of an integrated IO, RBV, and CAS model. Applied examples of such integration were found interwoven in all three strategic horizons.

For example, confronted with strategic challenges related to profitability (H1), our findings clearly indicate that managers apply elements of both IO and RBV theory to maximize outcomes. As an example of IO-influenced strategy, the strategic migration of production facilities in order to take advantage of regional labor cost disparity is arguably an applied response utilizing Porter's five forces (Porter, 1980), which is often acknowledged as the basis for IO strategy (Spanos & Lioukas, 2001). However, turning to another profit-enhancing initiative, R&D programs designed to lower the cost base to achieve competitive advantage are a key tenet of RBV theory (Porter, 1991). Additionally, many managers stressed a need to create “heterogeneous” cost advantage through strategic alliances, which is also indicative of RBV-directed strategy (Spanos & Lioukas, 2001).

Similarly, in Horizon 2, in many firms studied, the strategic efforts directed at extending and exploiting core competencies integrate elements of both IO and RBV theory. For example, many managers during the model-validation process agreed on the importance of initiatives designed around the RBV concept of building on established products for profitability (Maijoor & Witteloostuijin, 1996). However, these same managers also agreed on the importance of applying an outside-in approach to strategy (Porter, 1991) for providing guidance in deciding how and where to ally with partners to achieve continuity of product lines through market expansion. Thus, for such managers applied perspectives from both schools were seen as essential elements for achieving a workable strategy.

Regarding the integration of IO and RBV perspectives into a strategy for H1 and H2 initiatives, managers did not indicate a conceptual dilemma with integrating the differing core logics (Lengnick-Hall & Wolff, 1999). They appeared to be comfortable dealing with the “paradigm” shifts associated with moving from the outside-in thinking that is characteristic of IO theory to the inside-out approach characteristic of RBV.

However, it became clear that the challenge of devising strategy for long-term Horizon 3 activities associated with pioneering new technical frontiers for the firm requires a strategic perspective that is most indicative of the CAS school (Stacey, 1995, 1999). Despite the difference in terminology used, our interview subjects spoke frequently about the desire to encourage a healthy ecosystem that is managed through effective knowledge management channels. Managers spoke of strategic alliances to adapt rapidly to continuous change, management of risk associated with rapid change, and the challenge of maintaining cultural integrity during rapid market evolution. These are all oft-identified aspects of CAS theory (Brown & Eisenhardt, 1998; Lengnick-Hall & Wolff, 1999). Furthermore, the open dynamic systems needed for self-organization and management of interactive agents outlined by Beinhocker (1997) were recurrent themes when managers discussed long-term challenges.

In direct contravention of research that indicates that IO, RBV, and CAS cannot exist together because of inherent difficulties in managing shifts between the core logics of the three schools (Lengnick-Hall & Wolff, 1999), our findings indicate that attempts to integrate strategic elements from all three schools are indeed occurring in practice. In short, whether or not Lengnick-Hall and Wolff are correct in their assertion that problems arise when trying to integrate the conflicting core logic of the three schools, our research indicates that such attempts are being made on a daily basis. In fact, it is our contention that in response to the question that initiated this article—Why do some companies perform better than others?—the answer in the passive-component industry in Taiwan seems to be: Some companies are able to integrate the three strategic horizons more effectively than others.

We feel that findings from our research are significant enough to encourage other parallel studies that confirm our conclusions and address the challenges that our conclusions raise. Perhaps first and foremost is to extend research into identifying the elements that facilitate the effective applied integration of the three schools. Additionally, hurdles that hinder such integration need to be understood. If integration is taking place out of necessity and if it is true that the influence of the core logic unique to each of the schools creates conflict with integration, steps need to be taken to try to devise strategic tools to manage such conflict (Lengnick-Hall & Wolff, 1999).

In any event, it is perhaps fitting to close with the observation that we were not overly surprised by the conclusion that strategy from IO and RBV schools still had a role to play alongside CAS-driven strategy. After all, despite the increasing complexity in some businesses, there remains a predictable element that can benefit from strategic guidance founded in traditional strategic theory. In our model, we borrowed the terms Horizon 1 and Horizon 2 from Beinhocker (1999) to describe these more predictable time horizons. Accordingly, in response to change and increased complexity, rather than replacing the strategic guidance of the past (IO/RBV) with new perspectives (CAS), further research into effective integration represents the strategic realities from the field.

References

Anderson, P (1999) “Complexity theory and organization science,” Organization Science, 10(3): 216-32.

Barney, J. (1991) “Firm resources and sustained competitive advantage,” Journal of Management, 17(1): 99-120.

Beinhocker, E. D. (1997) “Strategy at the edge of chaos,” McKinsey Quarterly, 1: 24-39.

Beinhocker, E. D. (1999) “Robust adaptive strategies,” Sloan Management Review, 4(3): 95106.

Brown, S. L. & Eisenhardt, K. M. (1997) “The art of continuous change: Linking complexity theory and time-paced evolution in relentlessly shifting organizations,” Administrative Science Quarterly, 42(1): 1-34.

Brown, S. L. & Eisenhardt, K. M. (1998) Competing on the Edge: Strategy as Structured Chaos, Boston, MA: Harvard Business School Press.

Cool, K., Costa, L. A., & Dierickx, I. (2002) “Constructing competitive advantage,” in A. Pettigrew, H. Thomas, & R. Whittington (eds), Handbook of Strategy and Management, London: Sage: 299-325.

Gnyawali, D. R. & Madhavan, R. (2001) “Cooperative networks and competitive dynamics: A structural embeddedness perspective,” Academy of Management Review, 26(3): 431-45.

Lengnick-Hall, C. A. & Wolff, J. A. (1999) “Similarities and contradictions in the core logic of three strategy research streams,” Strategic Management Journal, 20: 1109-32.

Liu, S.-C. (2001) “The relationship among entry strategy, industrial network development and operation performance: A case study of Taiwan passive component industry investing in mainland China,” unpublished Master's thesis, Taiwan: Chung Yuan Christian University.

Maijoor, S. & van Witteloostuijn, A. (1996) “An empirical test of the resource-based theory: Strategic regulation in the Dutch audit industry,” Strategic Management Journal, 17(7): 549-69.

Peters, T. (1988) Thriving on Chaos, New York: Alfred A. Knopf.

Porter, M. E. (1980) Competitive Strategy, New York: Free Press.

Porter, M. E. (1991) “Towards a dynamic theory of strategy,” Strategic Management Journal, 12: 95-117.

Spanos, Y. E. & Lioukas, S. (2001) “An examination into the causal logic of rent generation: Contrasting Porter's competitive strategy framework and the resource based perspective,” Strategic Management Journal, 22: 907-34.

Stacey, R. D. (1995) “The science of complexity: An alternative perspective for strategic change process,” Strategic Management Journal, 16: 477-95.

Stacey, R. D. (1999) Strategic Management and Organizational Dynamics: The Challenge of Complexity, Philadelphia: Trans-Atlantic Publications.

Strauss, A. & Corbin, J. (1990) Basics of Qualitative Research: Grounded Theory Procedures and Techniques, London: Sage.

Venkatraman, N. & Subramaniam, M. “Theorizing the future of strategy: Questions for shaping strategy research in the knowledge economy,” in A. Pettigrew, H. Thomas, & R. Whittington (eds), Handbook of Strategy and Management, London: Sage: 461-74.

Wenerfelt, B. (1984) “A resource-based view of the firm,” Strategic Management Journal, 15: 171-80.

Wood, R. (1999) “The future of strategy: The role of new science,” in M. R. Lissack & H. Gunz (eds), Managing Complexity in Organizations: A View in Many Directions, London: Quorum.