Exploring the nature of nonlinear organizational change:

A case study of a ‘run-on-deposits’

Christian L. van Tonder

University of Johannesburg, ZAF

Abstract

The notion of nonlinear change, the most recent addition to the lexicon of change types, emerged as a logical extension of viewing organizations as complex adaptive social systems. As such it may be nothing other than a ‘label’ following a rich tradition of poorly conceptualized change concepts, yet may also contain the promise of improved explanatory power with regard to organizational change dynamics. This paper explores the theory of nonlinear change with particular reference to macro-scale and micro-scale change processes and tests its application with a ‘bank run’ or ‘run-on-deposits’ in a case organization. The retrospective analysis of newspaper reports covering a period of 18 months echoes the theoretical fundamentals of nonlinear change and highlights the central role of human affect as a catalyzing source of nonlinear change, the importance of ‘field’ (context), and the need for changed managerial approaches to minimize the catastrophic impact of nonlinear change.

Introduction

It has been established that between 65 and 75% of organizational change initiatives are deemed unsuccessful (Beer & Nohria, 2000; Grint, 1998; Mourier & Smith, 2001; also cf. Applebaum & Wohl, 2000; Mariotti, 1998). One reason may be the fact that the extant change literature guiding organizational change efforts has not been developed on a sufficient scientific basis (Bamford & Forrester, 2003; Van Tonder, 2004c). This situation is not aided by the fact that managers tend to cling to change concepts and practices that are substantially outdated and invalid (cf. Collins, 1996; Nortier, 1995). Indeed, the study of change has remained an insufficiently circumscribed and attended to phenomenon, exhibited, for example, in the fact that the distinction between change as empirical phenomenon and as subjectively experienced is hardly taken into consideration. (Collins, 1998; Pettigrew, 1988, 1990; Van Tonder, 2004c).

The arrival of complexity theory in the social sciences has stimulated renewed interest in the study of organization change as it promises a potentially more useful framework with which to make sense of otherwise inexplicable organizational change dynamics (Van Tonder, 2004b). It is in fact now quite common to view organizations as complex systems (cf. Ashmos, et al., 2000; Beeson & Davis, 2000; Dooley & Van de Ven, 1999; Maguire & McKelvey, 1999; Styhre, 2002; Sullivan, 1999). Against this context the purpose of this paper is to explore and test the theory of nonlinear organizational change through application to a recent case of a ‘bank run’ or a ‘run-on-deposits’.

We follow Van Tonder’s (2004a) view of change as a dynamic, time-bound, and non-discrete process evident in an empirical difference over time in the state and/or condition of the entity with or within which it occurs. Acknowledging the difficulty of pinning down complexity in a definitional sense (Maguire & McKelvey, 1999), the view of complexity used here is an exceedingly common one that veers towards ‘descriptive complexity’. It is accordingly viewed as that mixture of a significant number of variables within a setting or ‘field’, a high degree of interdependence between them, as well as a high frequency of interaction among these variables. Thiétart and Forgues (1995) for example suggested that complexity, in organizational terms, commences when three or more variables are interdependent and interact on a consistent basis.

Context: The evolution of change and type change

We also note that Lewin’s (1951) initial notion of change as a sequence of activities that emanate from disturbances in the stable force field that surrounds the organization (or object, situation, or person) has since been superseded by, among others, concepts such as first and second-order change (Bartunek, 1993; Bartunek & Moch, 1987; Watzlawick, et al., 1974), Alpha, Beta, Gamma change (Golembiewski, et al., 1976), transformation (Levy & Merry, 1986), evolutionary and revolutionary change (cf. Greiner, 1972; Tushman & Romanelli, 1985; Gersick, 1991), Type I and Type II change (Van Tonder, 1999) and more recently chaotic change (most often referred to as nonlinear dynamics or chaos—cf. Thiétart & Forgues, 1995) (See Table 1 for a selection of the more common and/or contemporary concepts).

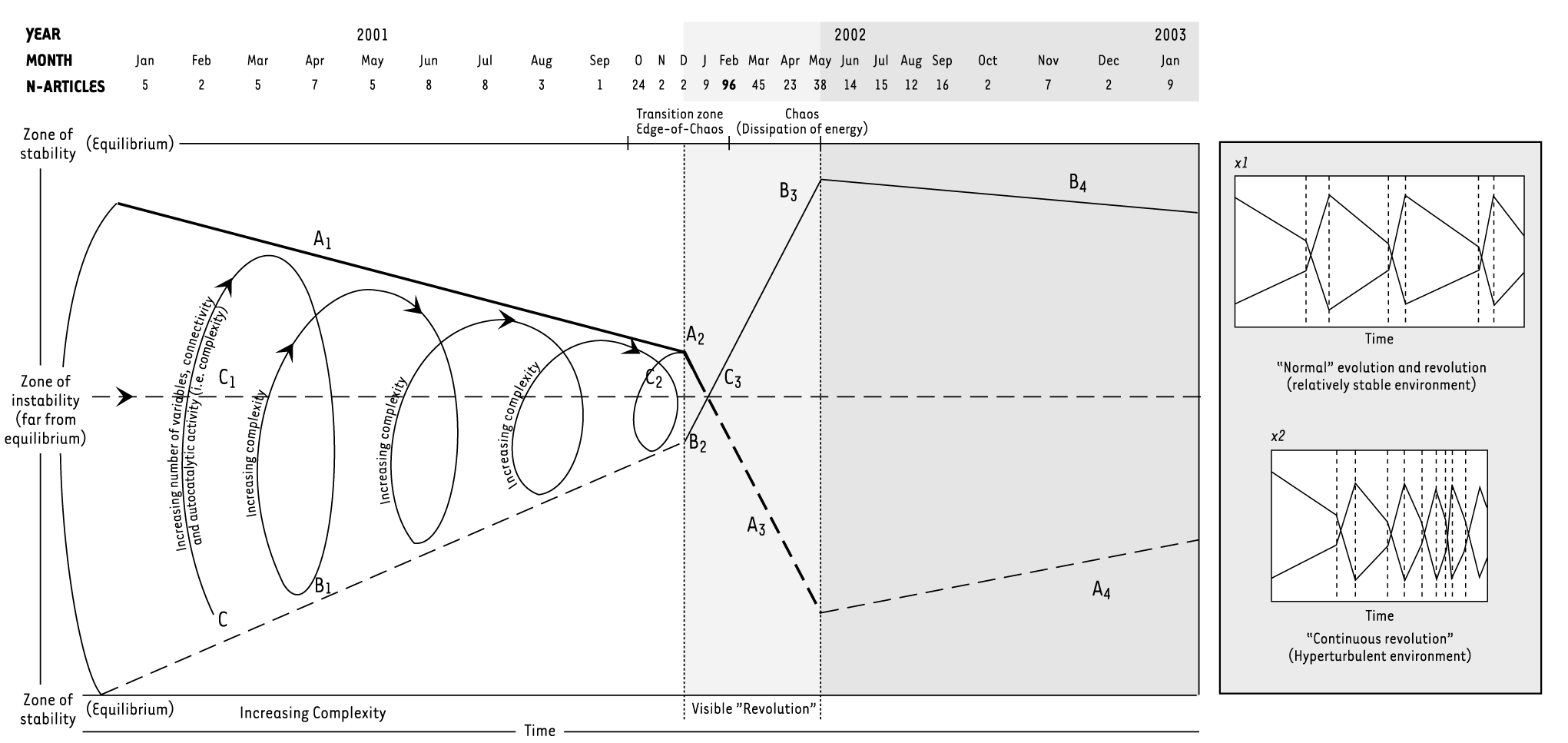

With every new change concept and typology that is created the veil of confusion that prevents the scholar and manager from understanding the nature and dynamics of change and organizational change, is lifted somewhat to reveal more of the elusive nature of change. Yet at the same time the various labels and imprecise definitions also compound problems of clarity. This is also the case with more recent change concepts which emerged from the application of complexity theory to the organization. Different expressions of nonlinear change such as complex, Type II, catastrophic, dissipative, chaotic, and fatal chaotic change consequently have surfaced in the literature, but they are used largely as synonyms. We use the phrase nonlinear change here conveniently as a collective phrase to encapsulate the different change concepts which, in character, appear to embody an ‘extreme’ type of change. A more useful approach that will circumvent the problem created by confounding ‘labels’, is to attempt description of the dynamics of the change process as, for example, on definitional parameters such as those suggested in Figure 1.

| ‘Conventional’ change types | ‘Extreme’ change types comparable or equivalent to a definition of nonlinear change |

|---|---|

| Chaotic change (also referred to as complex change or catastrophic change): A rapidly unfolding form of comprehensive change, triggered by an insignificant or small incident, with unpredictably catastrophic outcomes. | |

| Evolutionary change: A slow stream of incremental adjustments in response to minor internal or external environmental changes (but essentially directed by the environment) and which accumulates over time to bring forth major qualitative change (e.g., the emergence of a new species) (equated to Darwinian gradualism). | Revolutionary change: Short, compact periods of disruptive and qualitative i.e. transformational change, also referred to as punctuational change. |

| First-order change: A quantitative and rational change of limited scope in one or a few dimensions, within and consistent with existing schemata (present understandings or meaning structures). | Second-order change: a qualitative and discontinuous change in the structure and form of schemata (or meaning structures), invariably resulting in a new worldview. At the organizational level, it will tend to be a multidimensional and multilevel change based on a different logic and observable in most behavioral dimensions. |

| Alpha change: Some variation in the existing condition or state of a phenomenon – also described as ‘on-the-scale’ change – implying that this variation is measurable in terms of a measurement instrument (scale). | Gamma change: Is a quantum shift in the way that a specific phenomenon or object is conceptualized. It entails the redefinition and reconceptualization of a phenomenon – a major change in perspective or frame-of-reference. Compared to Alpha and Beta change, it is described as ‘off-the-scale’ change. Whereas Alpha change involves observed variation or visible change, Beta change involves a modified view of this change and Gamma change a complete conceptual redefinition. |

| Type I change: A steady state, incremental or step-by-step sequential change which generally evolves over an extended period of time, does not have a disruptive influence on the system and is generally perceived to be within the control of the system. | Type II change: A major, disruptive, unpredictable, paradigm-altering and system-wide change which has a very sudden onset and escalates rapidly to a point where it is perceived as being beyond the control of the system. |

| Transformation (or transformational change): A qualitative and metamorphic form of change, which entails a fundamental and material alteration of the structure, nature, and appearance or shape of an entity such as an organization. |

Table 1 A selection of change types (source, Van Tonder, 2004c)

When we attempt to delineate the nature of different change types in terms of the basic defining parameters in Figure 1, meaningful convergence and divergence among the different change concepts emerge in a manner quite unlike that implied by seemingly different labels. Variations among different types of nonlinear change (should they exist) can potentially be differentiated on the basis of dynamics rather than ambiguous ‘labels’ that presume variation. While it is beyond the scope of this discussion to elaborate on the implications of different types of change, the benefit of profiling change for purposes of research and organizational practice is obvious. The parameters suggested in Figure 1 should enable the profiling of varied change processes or episodes ranging from, for example, a heart attack to the gradual unfolding of an ecosystem. A caveat though; although most change events or processes may be amenable to a degree of description, precise definitions of the points at which change commences and concludes are bound to be sources of debate, as change is hardly ever discrete, and subjectively perceived and experienced.

Figure 1 Descriptive parameters and scaling of change processes or events

Nonlinear change

In general, nonlinear systems are typically described as systems of perpetual change, but this is an incorrect representation for it is not change per se that distinguishes it from other systems. Closed and open systems are characterized equally by perpetual change (although seldom recognized). Rather, it is the qualitatively different profile and nature of the type(s) of change in nonlinear dynamic systems that differentiate them from that of the ‘traditional’ systems concepts.

If we then turn to nonlinear organizational change, we are reminded that the meaning parameters of any conceptualization of change is anchored in, and typified by, the context within which it occurs (Bolton & Heap, 2002; Van Tonder, 2004b, 2004c). When we acknowledge the existence of different (valid) forms of nonlinear dynamic systems (e.g., complex versus chaotic systems) we implicitly subscribe to change forms that, in broad terms are similar, but at a finer level of discrimination will reflect variance, which is associated with the dominant and distinctive features of these systemic contexts, e.g., ‘complex’ and ‘chaotic’ change.

While complex and chaotic systems differ in several meaningful ways, the primary distinction is that complex systems are only occasionally exposed to chaotic change dynamics. For the rest, fairly ‘ordered’ change types such as Type I or evolutionary change (see Table 1) i.e., change profiles likely to be conveyed by lower values on the defining parameters in Figure 1, will be observed. This is a consequence of a complex system’s ability to consolidate and reintroduce stability after nonfatal chaotic change.

Some authors for example differentiate between subtypes of nonlinear dynamic systems which include conservative and dissipative systems. The former, which includes classical and quantum systems, essentially conserve energy while dissipative systems are characterized by the movement of energy across ‘field potentials’ into the surrounding environment (‘dissipation’). Indeed, the (accelerated) movement of energy constitutes a central feature of Prigogine & Stengers’s (1984) concept of a dissipative structure. These nonlinear dynamic or complex change types are to a degree ‘knowable’ in terms of the framework provided in Figure 1, and we consequently observe that nonlinear change largely populates the extremities of the descriptive parameters (values are likely to range between 4 and 5).

The bulk of the literature suggests that nonlinear change is change characterized by the disproportionate magnitude of the change trigger (insignificantly small) and the change consequence (unpredictably large), i.e., nonlinearity. In chaotic systems nonlinear change would assume the character of fatal, catastrophic change, as well as non-fatal chaotic change. In complex systems the phrase will embrace similar nonlinear change with the rider that, through intervention, the change may be stabilized to a degree and convert/switch to more linear forms of change. In such instances the concept of fatality may be muted and a limited degree of reversibility of impact over time may be possible.

In the instance of dissipative structures in particular (e.g., organizations), nonlinear change is further construed from within a ‘field’ of forces and is described in terms of the flow of energy across energy differentials. In keeping with our argument of earlier, a finer distinction between different nonlinear change types at this stage, i.e., beyond complex and chaotic change (for example between ‘conservative nonlinear change’ or ‘dissipative nonlinear change’), may prove to be substantially impractical. Our basic defining parameters of change (Figure 1) should prove more useful. From this perspective the basic tenets of nonlinear dynamic systems would suggest that nonlinear change will simultaneously be prominent on at least the dimensions of predictability, control, impact and probably pace, for it to be regarded as such. The ‘surprise’ or ‘suddenness’ feature of nonlinear change is, for example, captured by the time/pace dimension. If we then further subscribe to change as “energy-on-the-move” (Van Tonder, 2004c) the time/pace dimension effectively articulates the rate of energy flow (cf. Goerner, 1995), which is characteristically prominent in dissipative systems. ‘Predictability’ in turn embodies the linearity-nonlinearity dimension of organizational change while ‘control’ reflects the perceived influence of organizational representatives based on their subjective estimation of the pace, intensity, scope, and predictability of the unfolding change. As with all change processes the manner in which the ‘beginning’ and ‘end’ of the change is defined, remains a critical consideration. In this regard some guidance can be derived from a consideration of the anatomy of nonlinear change at both a macro and a micro scale, which is illustrated with an example from the financial sector.

A case in point: Nonlinear change in the financial sector

The financial sector, surprisingly, has been characterized by several examples of what can be termed nonlinear change (Rosser, 2002). Indeed, Demirguc-Kunt & Detriagiache (1998) have identified 31 banking crises for the 14-year period between 1980 and 1994. Of these, several were accompanied by massive attempts by depositors to withdraw their funds—referred to as a ‘run-on-deposits’ or a ‘bank run’. Despite analyses of substantial ‘panic runs’ dating back to 1890 (cf. Kindleberger, 1996), it is still not possible to anticipate and prevent bank runs. According to Ortiz, (2002) several common features characterized the crises that emerging market economies experienced after 1994, namely that the affected economies were considered star performers; the crises were not anticipated; and the magnitude of the crises were much larger than expected. This articulation provides a succinct summary of what is referred to here as nonlinear change and applies equally well to events at the case organization (a banking institution).

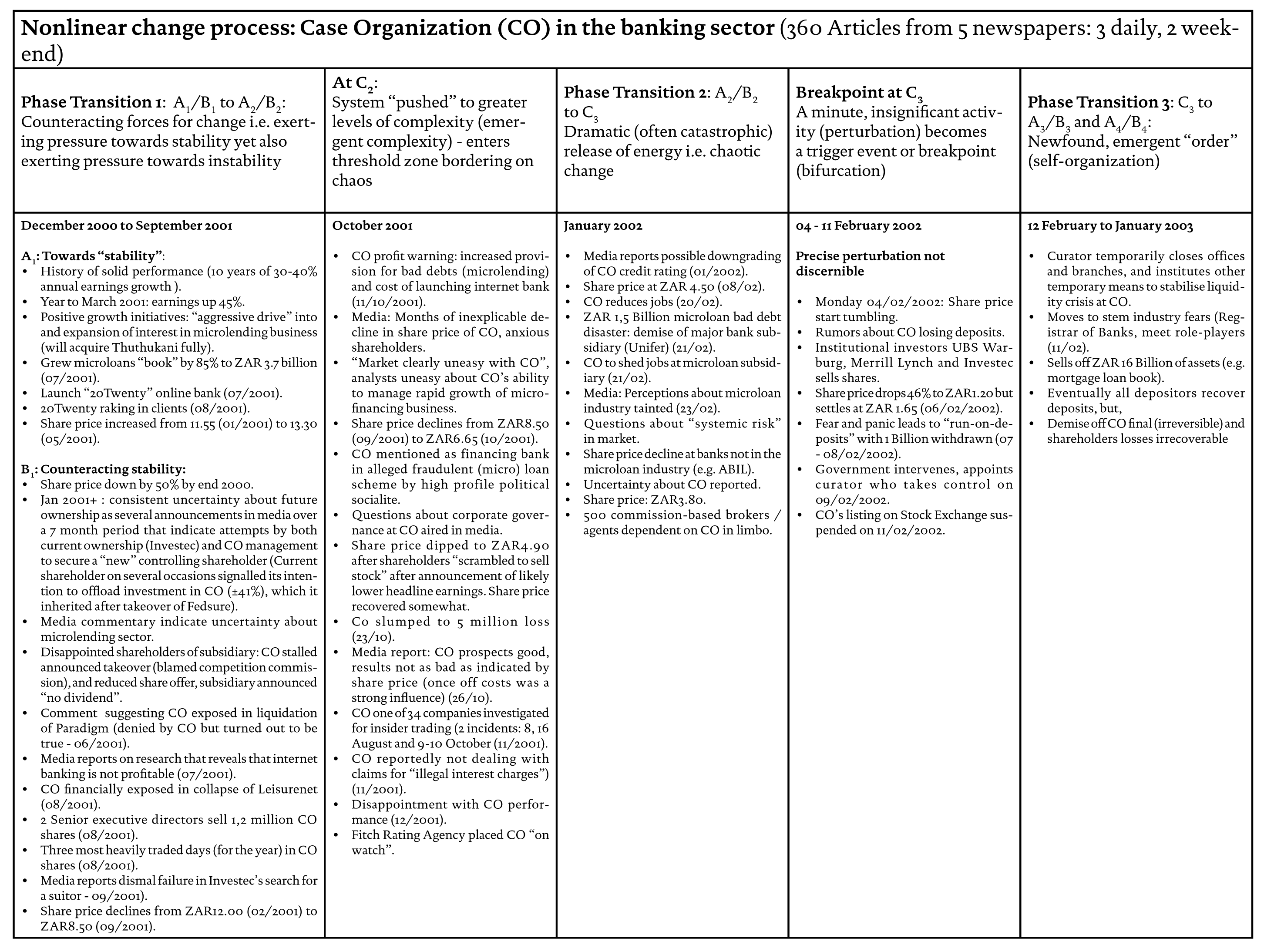

With annual returns to shareholders varying between 30% and 40% for the last 10 years, the run on its deposits at the case organization was sudden and unexpected and, although its balance sheet was sound, this could not avert its collapse. Following state intervention, the dynamics in the bank (as well as the rippling effects throughout the industry) were stabilized, but the bank’s assets were sold, which marked its permanent demise. Drawing on 360 newspaper reports covering approximately a year before and after the ‘run’, unfolding events were fitted to a theoretical model of nonlinear change (Figures 1 and 2). The ensuing discussion illustrates the nature of nonlinear change at both macro- and micro-scale.

Anatomy of nonlinear change: Macro-scale

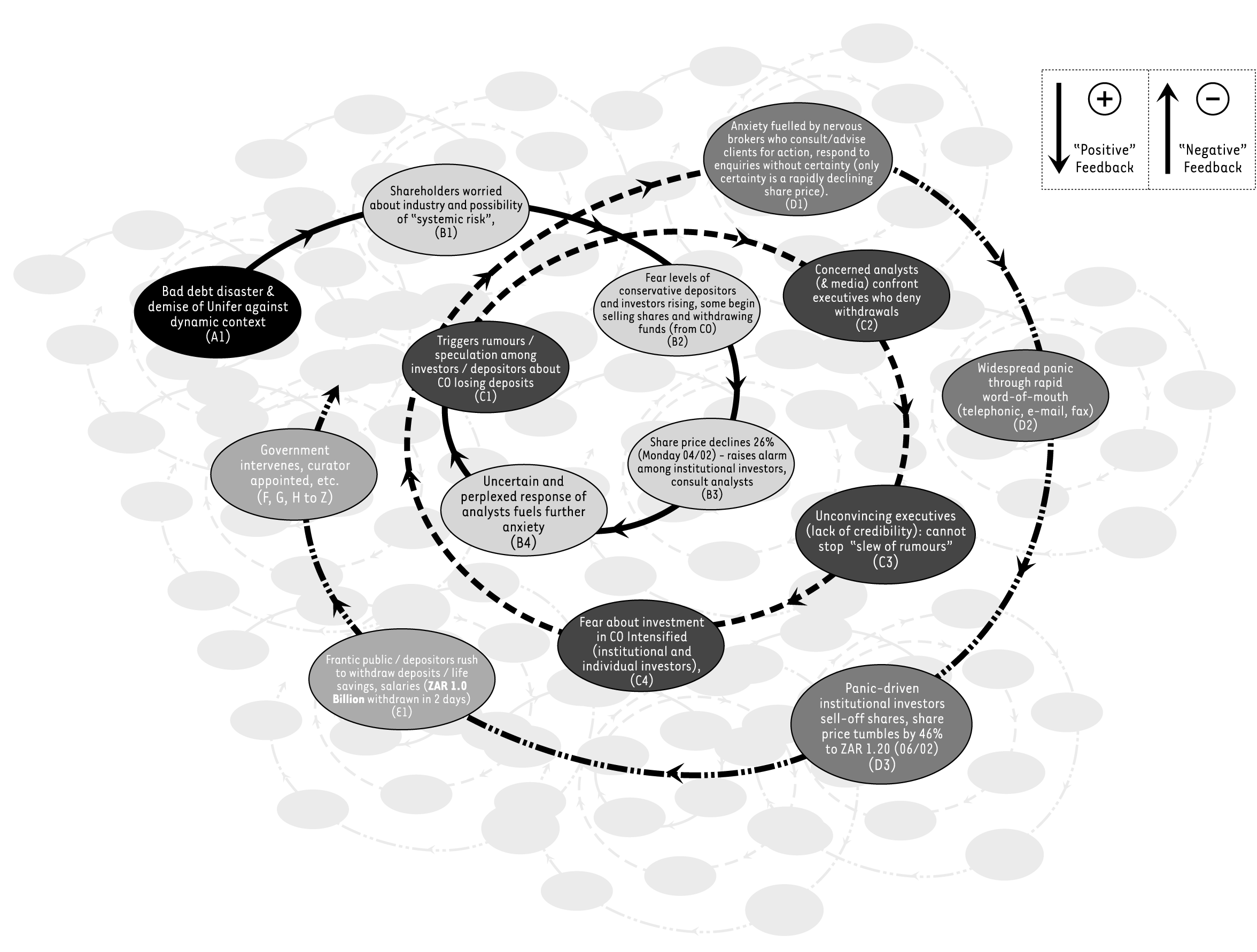

A macro-scale nonlinear change in organizations is one of cyclical order and disorder that can be further disaggregated into three major phase transitions (see Figure 2) with the first representing the shift from relative stability and minimal complexity, to complex and fragile stability on the edge-of-chaos. The second phase transition refers to the organization’s crossing over into the domain of chaos and ultimately its descent into chaos, while the third phase transition represents the emergence of (a ‘leap’ to) a new level of order and stability. In phase 1 the organization is subjected to powerful yet balanced counteracting forces which simultaneously exert pressure towards stability (A1), yet also towards instability (B1). With passage of time the organization is ‘pushed’ to greater levels of complexity and into a threshold zone bordering on chaos (C2) referred to as the ‘far from equilibrium’ zone and ‘the edge-of-chaos’. If the organization cannot contain the energy build-up and increasing complexity, a minute, insignificant activity (perturbation) could become a trigger event or breakpoint (‘bifurcation’—C3) which will prompt a dramatic, chaotic phase transition (A2 to A3 and B2 to B3 in Figure 2), from which newfound ‘order’ and stability will emerge—if not in the organization, then in the supra-system (e.g., at industry level). If increasing complexity and energy build-up over time cannot be ‘managed’, the system lapses into the next order-disorder-order cycle.

Figure 2 Instability, complexity and chaotic change (adapted from Van Tonder, 2004c, with permission of Van Schaik Publishers)

Unfolding events at the case organization leading up to and culminating in the ‘run on deposits’ fit the phases of nonlinear change exceedingly well and allude to the intensified pressure and growth in complexity (see Figure 3).

Anatomy of nonlinear change: Micro-scale

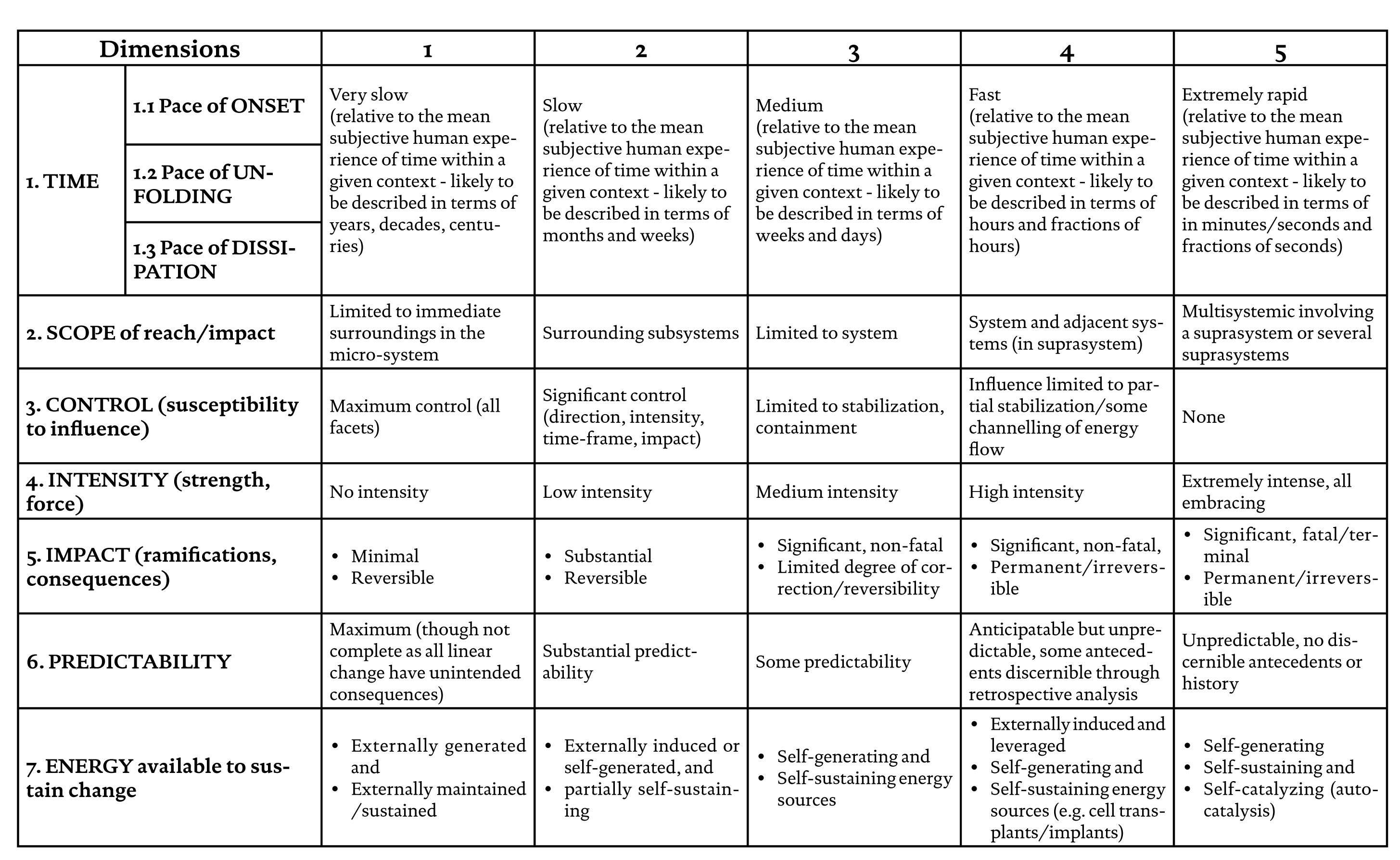

Nonlinear change at micro-scale more pertinently refers to the second phase transition of the organization from the edge-of-chaos to the domain of chaos proper, and embodies the dramatic visual revolution referred to earlier (refer Figure 2: from A2/B2 to C3) and which requires only a minute perturbation (at A2/B2) to prompt the onset and ‘descent’ into chaotic change at point C3. Figure 4 demonstrates this (hypothesized) spiraling chain of causal events in the case organization, which co-contributed to the ‘run-on-deposits’. The reconstruction of events is sequentially sound and has been cross validated and reveals crude causality at this level of analysis, but it omits the multitude of iterative ‘transactions’ that occurred (often simultaneously), among system components (e.g., employees), between the system and the context or supra-system (e.g., between employees, managers and directors on the one hand, and shareholders, analysts, auditors, the media, service providers, etc. on the other), and among supra-system components (e.g., industry executives and institutional investors, brokers and analysts, media representatives, government officials, depositors, etc.). These ‘transactions’ performed powerful reinforcing (‘positive’) and suppressing (‘negative’) feedback roles in a complex web of interactions. For this reason further disaggregation of behavior at this level of analysis of the ‘run’ dynamics, and the pursuit of causality is a practical impossibility. However, two micro change processes, namely autocatalysis and resonance, further broaden our understanding of nonlinear change at this level.

Autocatalysis, resonance (“correlation”) and energy flow

A micro-scale nonlinear change is perhaps best illustrated with behavioral examples that have variously been referred to as ‘swarming’ or ‘herding’ behavior in social collectives. Grint, (1998) refers to the collective catastrophic hysteria that was observed for example in vanquished armies for no apparent reason, while Ortiz, (2002) highlighted ‘herd behavior’ (together with ‘panic’, external shocks, and several other factors) in major balance-of-payment crises. In these examples nonlinearity is once again confirmed in the disproportionately large consequence (hysteria, panic) relative to a minuscule trigger event. A second major feature of this behavioral phenomenon is its ‘runaway’ nature, i.e., the absence of control, which assumes a dynamic of its own (an emergent phenomenon) which ultimately culminates in catastrophic outcomes. Autocatalysis and resonance bring more descriptive clarity at this level.

‘Autocatalysis’, technically, cannot be disentangled from the complementary micro process referred to as ‘resonance’ or ‘correlation’, but for our purposes it is necessary to differentiate the two micro change processes. Autocatalysis or autocatalytic interaction can be described as a continuous, self-sustaining, iterative and recurring excitation process that occurs when a suitably high degree of complexity characterizes the nonlinear dynamic system and a significant energy differential (‘field potential’) exists as, for example, when the organization finds itself at the edge-of-chaos (A2 and B2 in Figure 2). The onset of a process of autocatalysis literally requires an insignificant trigger or perturbation to stir system components into spontaneous catalysis, i.e., exciting and energizing one another. System energy accumulates and converges and resonates (a function of the self similarity characteristic of nonlinear dynamic systems) which then amplifies and further excites the system on a continuous, and exponentially spiraling, basis until a point of ‘critical mass’ (and breakpoint) is reached, i.e., when the ‘field potential’ is such that spontaneous dissipation occurs (i.e., chaotic change or release of energy). Autocatalysis facilitates and accelerates processes that would otherwise not have occurred or would have occurred at a very slow pace. High interdependence among system components ensures that ‘stirred-up’ energy is continuously fed back into the system and into the ‘stirring-up’ process where it amplifies and fuels the process (a positive feedback loop), and consequently leads to the development of a network of catalytic events. Non-reinforcing feedback, which dampens energy flow and excitation (i.e., negative feedback loops), also occurs, but these are significantly negated by the extent of positive feedback.

‘Resonance’ or ‘correlation’ in turn refers to the alignment and channeling of energy from system components and which have been mobilized through excitation. It is this aligned mass of energy in circulation that leads to the emergence of some systemic phenomenon. For resonance to occur, a substantial degree of self-similarity (recurring systems features, regardless of the level of scale) has to be present. In essence autocatalysis energizes and mobilizes, while resonance organizes and directs the flow of energy.

From within a dissipative structures perspective this spontaneous and ever-spiraling process of excitation-resonance-amplification-excitation (refer Figure 4) results in the accumulation and convergence of spontaneously released energy until a significant ‘field potential’ is reached, i.e., a significantly large discrepancy between different concentrations of energy.

Figure 3 Unfolding events during nonlinear change in a banking organization

Once this energy differential reaches a critical magnitude a spontaneous flow of energy from high to low concentrations (‘dissipation’) occurs (Prigogine & Stengers, 1984). Goerner, (1995) describes this critical value, or breakpoint, as the moment when the system has reached its maximum flow capacity—a threshold parameter that marks the point where the energy differential between interdependent, but opposing, change forces reaches an unknown yet specific critical proportion and is vulnerably sensitive to the smallest energy fluctuations in the ‘field’. If energy build-up continues a ‘search’ for a more efficient energy outlet to release the pressure is prompted. Increasing pressure is then concentrated in those areas where less resistance is encountered, until it gives way in the form of a ‘chaotic’ dissipation of energy.

In the case organization change-reinforcing (‘positive’) feedback amplified and accelerated energy flow and build-up in the absence of significant resistance (‘negative’ or disorder dampening feedback) until the energy flow reached the maximum flow capacity. For the case organization this occurred when the capricious emotional disposition of institutional investors prompted the sale of their shareholding. It is at this point that the critical threshold is crossed and the system ‘switched’ (‘bifurcated’). Energy was redirected to this new flow channel (sale of shares, withdrawal of deposits) which resulted in a spontaneous and dramatic flow, or dissipation, of energy (the ‘run’ on the deposits) to the point of levelling out resource (energy) concentrations, i.e., restoring a condition of equilibrium.

A useful illustration of change in the form of energy dissipation is provided by the example of an in-flight accident that ruptures the aircraft’s frame, to the extent that the highly pressurized cabin atmosphere is brought into contact with the substantially depressurized surroundings of the aircraft. The pressure differential (‘field potential’) prompts an immediate and intense rush of air (energy flow from a high to low concentration which, depending on the magnitude and reversibility of the change consequences, may be categorized as either fatal or non-fatal chaotic or nonlinear change. We can also equate the build-up of energy among systems components in complex, nonlinear dynamic systems to the build-up of emotional energy in individual employees as a result of autocatalysis among employees in, for example, an employee complaining to another about treatment by a manager, which invokes sympathetic anger and leads to more rousing word-of-mouth, etc. This being the case, we also immediately recognize the parallels between the dramatic dissipation of energy in a complex adaptive system such as an organization, e.g., a strike by the workforce, and from a psychoanalytical/Freudian perspective, the cathartic release of emotional tension at the individual level. Autocatalytic change at this level suggests a period of optimum synergy when near perfect alignment among human systems (psychological, physiological, etc.) is momentarily achieved—to the extent that intra-systemic constraints (resistance) is minimal, resulting in the spontaneous rapid release of energy of significant proportions which are substantially disproportionate to the stimulus value (consider also Freud’s metaphorical ‘breaking of the dam wall’ as a human application of dissipative systems change—Van Tonder, 2004c). It is here that the psychology of the individual, or to be more precise, the deeply entrenched preconscious and intertwined elements of cognition and emotion, surface from the ‘past’ to rouse and rally the various intra-individual systems into coherent collective action.

Of particular importance is that this circular exchange of energy between systems and system components in a field is necessary for self-organization (Coleman, 1999), but this self-organization can emerge at different systemic levels: if the organization’s identity is maintained through the different organization-environment interactions and phase transitions, the organization will emerge in a revitalized new form. In the case organization this circular exchange of energy extended uncontrollably beyond the confines of the organization and consequently its identity was not sustainable. Self-order subsequently emerged at a higher systemic level, i.e., at the ‘field’ level, which took the form of intervention by the state and the introduction of industry-specific regulations and measures to contain similar forms of chaotic change in the future.

Discussion and implications: Nonlinear change and retrospective sense making

The retrospective ‘fit’ of a nonlinear change framework (macro- and micro-scale) onto the case organization provides substantial explanatory power with regard to the dynamics and possible origins of the ‘chaotic change’ to which it was exposed. Depending on the vantage point, this change can be characterized as either ‘fatal’ or ‘nonfatal’ nonlinear change:

- At the institutional level the change was fatal: the institution collapsed, most shareholders and stakeholders lost their equity, and what assets remained (e.g., mortgage and other loan books) were taken up by other players in the industry

- At the level of the individual ‘agent’ the change would be deemed ‘nonfatal’ as a degree of reversibility could be secured with most investors and depositors eventually recovering their life savings and investments in the aftermath of the catastrophic demise of the case organization. This in itself serves as an indication of an emergent structure, as it was difficult to predict recovery of deposits in the immediate months surrounding the ‘run’.

Figure 4 Hypothesized autocatalysis in the ‘run-on-deposits’ of a banking institution. Adapted from Van Tonder, 2004c, with permission of Van Schaik Publishers.

The relative ease with which the nonlinear change ‘template’ could be fitted to the case organization undoubtedly introduced greater clarity on the nature and dynamics of nonlinear change in complex adaptive social systems (such as the case organization) and surfaced a plausible account of the unfolding events and outcomes at the case organization. It has to be acknowledged however that this was only possible from retrospective analysis of post-change data that cannot be anticipated in a pre-change, or even in an amidst-change situation. Secondly, although causality (as illustrated in Figure 4) has been obtained from deconstructing valid, ‘real’ change data, we cannot penetrate below this level to specifics: minuscule autocatalyzing events cannot be ‘unpacked’ and reduced to an absolute level, and it is still impossible to identify the precise nature of the causal conspiracy that prompted the onset of chaotic change and the rapid dissipation of resources (‘run-on-deposits’). In this case Goldstein’s (1999) criteria for emergent phenomena are affirmed: the situation cannot be reduced to the precise initial causal conditions that were instrumental in its emergence (even in a post change situation). At the same time it is an impossibility to deduce the emergence of the ultimate state of affairs on the basis of knowledge of the parts prior to and during the unfolding change.

The fact that intervention by the State and the entrance of major financial players that acquired the assets of the defunct bank could ‘stabilize’ nonlinear dynamics in the broader ‘field’, confirms the view that few economic environments are indeed chaotic—that they are more likely complex (cf. Maguire & McKelvey, 1999: 35). Viewing the case organization as operating in a complex rather than a chaotic domain, allows us to reconcile irreversible changes (demise of the organization, shareholder losses) with reversible changes (return of funds to depositors).

At the same time the analysis results validate the proposition that order arises in complex adaptive systems because system components are partially connected (or “loosely coupled”—Weick, 1995), for if all system components (organizational actors) were fully interconnected, chaos would ensue, or decay would result (Anderson, 1999). It is evident that in the lead up to the ‘run-on-deposits’ the network of interconnected elements increased exponentially—a dynamic that was mediated significantly by media coverage and word-of-mouth among analysts, investors and depositors/clients.

Financial and economic journals reporting on ‘runs’ of this nature (e.g., Eisenbeis, 1997; Miller, 2003; Ortiz, 2002) consistently suggest random exogenous shocks to be at the source of these financial crises, which emphasize the centrality of context-system interdependence. Retrospective analysis of the case organization also tangibly revealed the presence of the ‘field’ during the unfolding change. The media (in this study the printed media) revealed the continuous presence (and involvement) of various components of the ‘field’ that coalesced to constitute ‘market sentiment’. Perspectives of industry leaders such as executives of the major banks, the reserve (central) bank and the registrar of banks, as well as commentary by analysts, questions by investors and depositors, and statements by government organs were constantly in evidence. Together they constituted a contextual ‘conspiracy’ for nonlinear change. In this the media performed an ubiquitous, but undetected, critical role which facilitated the development of more interdependencies and in fact accelerated the system’s development towards greater complexity. The onset of chaotic change, as well as emergent self-order in the case organization, were clearly influenced by the organization’s contextual interconnectedness—a point also argued in the economic literature (cf. Smith, 2001) and which reaffirms Goerner’s (1995) position that self-organization, contrary to erroneous accounts that portray it as an isolated development or event, is in fact highly intertwined with contextual (‘field’) dynamics.

Nonlinear change and human emotion

It is at this point that we need to substantially elevate the role and contribution of emotion in human affairs and consequently in complex adaptive social systems. In what constitutes a strange aberration of organizational reality, it is observable that emotion traditionally and historically has been neglected as a variable of note in organization theory (Albrow, 1992; Czander 1993; Elieli, 1994) and indeed in day-to-day organizational practice and management (Lundberg & Young, 2001). This consistent oversight is a legacy of the dominant functionalist paradigm of viewing organizations, which still undergirds contemporary managers’ beliefs that organizations and change are manageable to an absolute degree. By contrast, psychological theories of organization depict the organization as a psychological arena where emotions (e.g., fear and anxiety) are pervasive but suppressed features of daily organizational functioning (Flam, 1993; Fineman, 1993).

Turning to the change literature, we observe that resistance to change, which is an emotion-informed employee response to change, is still considered one of the most prominent but little recognized causes for failed change initiatives (Dehler & Welsh, 1994; Maurer, 1997; Reger, et al., 1994; Spiker & Lesser, 1995; Waldersee & Griffiths, 1997), which stems from the overly cognitive and rational managerial approach to dealing with organizational change that is so prevalent in managerial change practices.

Against this context the data on the case organization (obtained from some 360 newspaper articles) consistently employed terminology such as fear, anxiety, uncertainty, anger, panic and related indicators of emotion—in particular during the phase transition to the edge-of-chaos and during the descent into chaos. This emotional vocabulary was most prominent during reports on the events immediately prior to, during, and after the ‘run-on-deposits’ (refer Figure 4) which corresponds with the high frequency with which emotion terminology is employed in economic and financial journals reporting on similar crises (cf. Demirguc-Kunt & Detriagiache, 1998; Eisenbeis, 1997; Miller, 2003; Ortiz, 2002). Of these, ‘panic’ is most commonly observed, but well supported by the use of terms such as ‘dissatisfaction’, ‘distrust’, ‘confidence’, ‘fear’, ‘shock’, as well as terminology that is informed by an emotional attachment such as ‘reputation’, ‘credibility’, and the like.

Staw and Sutton’s (1993) reference to the powerful and dramatic consequences of aggregate (collective) affective states (as for example in the case of ‘market sentiment’ that changes rapidly on the basis of speculation and spreads even more rapidly through ‘contagion’) parallels the ‘run-on-deposits’ illustrated in Figure 4. Both these incidents are examples of the so-called ‘herding’ or ‘swarming’ behavior and reveal substantial parallels with what has variously been referred to as manias (Kindleberger, 1996), contagion (Freedman, 1982) and epidemic hysteria (Sirois, 1982). Apart from the fact that these examples reveal the fickle nature of socially constructed reality (e.g., ‘the market’, ‘banks’) and its intricately intertwined relationship with human emotion, they reify the processes of autocatalysis and resonance, i.e., processes of ‘fueling’ or facilitating group affect such as mania, distress, panic, etc. to the point of collective action. Aggregate (collective) affect in this instance is an example of systemic self-similarity where group affect in nature/character replicates individual affect at a lower systemic level. The significance of this statement is derived from contemporary research on emotion that reveals it to be central to sense making, and that cognitive representations are not separate from affects associated with specific events (e.g., phobias are excellent examples of the distinctive meaning-affect schemata that individuals construct). As a consequence, parallel or dual-processing models of perception that integrate emotive and cognitive elements are now considered more representative of human cognitive functioning (cf. Epstein, 1994; Epstein, et al., 1992). Moreover, according to Zajonc, (1998) an impressive number of neuro-anatomical studies have demonstrated that the very first reaction in a response pattern is an affective one, signifying that the process of establishing emotional significance occurs faster than the process of extracting meaning. It is consequently possible to fear something before knowing it (Zajonc, 1998: 607).

The primacy of affect over cognition in human functioning (at least initially) reveals the acute sensitivity of the human system to threat and, consequently, also that of social collectives—as illustrated in the earlier mentioned examples of ‘herding’. This is necessary to mobilize energy for an appropriate fight-or-flight reaction, which in turn will materially influence the nature and character of subsequent cognitive processing (Van Tonder, 2004c). Following from this premise we argue that the source of variance and therefore nonlinearity in complex adaptive social systems (but also other nonlinear dynamic systems that display a meaningful human interface) resides in the idiosyncratic schemata (cognitive-affective mental representations) of individuals. It is ‘human content’ that constitutes the element of shift from relative stability to the edge-of-chaos and beyond. This, together with Pascale’s (1999) argument that a living system cannot be directed—only disturbed (p. 85), has important implications for institutional management, which we elaborate in the ensuing sections.

Nonlinear change and institutional management

Although examples of disastrous (nonlinear) change are still relatively few, the incidence of this form of institutional change is increasing. Our concern, however, is that while scholars may recognize the possibility that a (seemingly) insignificant perturbation in a complexly poised business setting could give rise to catastrophic organizational change, managers and practitioners may be somewhat disinclined to consider this a material possibility in day-to-day organizational functioning. It is therefore unlikely that the utility value of these ‘new’ change concepts will be recognized. This is undesirable as the uncontrollable and irreversible nature of these extreme forms of nonlinear change do not allow the organization the luxury of first piloting an approach to eventually deal effectively with the change, nor does it afford management the opportunity to engage in retrospective reflection and learning in the aftermath of nonlinear change—other than in a completely new organizational reality and context where the past is likely to have a minimal influence.

Part of the problem of managers not necessarily subscribing to a complexity view of organizations, arises from the absence of suitable theoretical and methodological frameworks that will enable them to recognize emergent phenomena (Goldstein, 1999). This echoes an earlier observation that managerial mind-sets are the critical focal area during times of complex change (Smith & Saint-Onge, 1996), a fact borne out by the actions of executives at different times in the unfolding demise of the case organization. Indeed, as Ashmos, et al., (2000) have asserted, the managerial task assumes a different, non-traditional, and more of a ‘sensemaking’ character, the moment managers recognize the complex adaptive nature of their systems. In the case organization this feature of the organization’s field-dependent dynamics remained undetected largely because of the inappropriately conditioned mind-sets of the management team.

The required mind-set change is suggested, in part, by what Lewin, (1999) has termed a new management logic. It essentially entails managing the organizational levers of dissipative energy (e.g., choosing competitive arenas, and setting strategic aspirations); establishing internal processes that facilitate various emergent processes as self-generated sources of dissipative energy (e.g., improvisation, and emergent strategies); cultivating an openness to, and acceptance of, bottom-up processes and alternative, equivalent final outcomes; and leadership styles that moderate dysfunctional tension and prevent the emergence of chaos. This is obviously easier said than done. While these ‘tasks’ provide clear direction in terms of what needs to be done, they are in need of further translation and reification, for embodied in this new logic is a fundamental organizational character change that poses extensive implementation challenges.

Grint’s (1998) suggestion that leaders should pay closer attention to individual discretion, and/or instituting systems with anti-chaotic procedures to facilitate stability rather than development towards greater complexity, alludes to the central role of the individual in the development of complexity. On the basis of our previously stated position on the role of human emotion and variability we would argue that the understated issue of ‘dysfunctional tension’ raised by Lewin, (1999) should in fact serve as a starting point for dealing more effectively with complex change.

Implications

It seems clear that the sensing capability (‘sensors’) of organizations do not enable detection of vital early indicators of nonlinear change. In the case organization this system deficiency was linked to executives, specialist staff (e.g., strategists, researchers), corporate advisors, auditors, corporate governance officers, and so forth. The sensitivity to perceive and respond to often minuscule changes in a dynamic environmental system is the most central and critical failing in complex change going awry. In the case of Enron Corporation, McLarney & Dastralla (2001) have argued that past success masked the multinational corporation’s ability to perceive and respond to changes of this nature, but we will argue that it is not so much a case of masking as it is a case of desensitization, which leads to denial and prevents an appropriate managerial focus from developing. When the system reveals an increasingly sensitive dependence on small and relatively insignificant occurrences, this should be matched with an equally sensitive awareness among management and key employees: a form of ‘hyper vigilance’ is required. Of course different modes of sensitivity may be indicated by the system’s status, in which case managerial sensitivity should be adjusted accordingly. When the organization’s functioning appears to be unfolding in a complex system setting (finding itself in a far-from-equilibrium situation) ‘hyper vigilance’ is indicated. However, if the system is clearly stable, the energy and system resources required for hyper vigilance can be preserved for utilization in other, more productive pursuits. This needed hyper vigilance would have to commence with what McGill, et al. (1992) refer to as a managerial openness to the widest possible range of perspectives. Sullivan, (1999) in turn has argued that an appropriate response would be for organizations to train their administrators to ‘read’ their organizations. Of course ‘read’ needs to be elaborated substantially to enable management and other boundary-spanning officials to detect patterns among incremental changes as they unfold. This implies:

An adequate knowledge base and understanding of complex adaptive systems theory and research (an enabling framework)

Cultivating an appropriate mind-set that accords greater significance to:

- system dynamics and the potential role of incremental developments and changes within a broader systemic ‘field’, and

- the human element (as carriers of the seeds of nonlinearity in complex adaptive social systems). Such a mind-set should firmly entrench the recognition that individuals and in particular employees are idiosyncratic and potentially unstable energy sources that possess the capability to ignite autocatalytic change that even they cannot adequately anticipate, recognize or contain.

The preceding point in itself suggests an intensified focus on human energy management (energy concentration and dynamics) and consequently we propose the adoption of an energy-sensitive mode of management, with a commensurate shift of managerial focus to energy flows and their management.

Coherent systemic observation and collective action in response to a multitude of often seemingly irrelevant environmental cues constitute the gist of arguments that promote organizational learning and the learning organization (cf. Dixon, 1999), but this is rarely observed in practice (Reynolds & Ablett, 1998). Although this may seem an idealistic requirement, this is precisely what is implied and called for by those who argue for organizational and managerial ‘openness’, ‘sensitivity’, ‘reading’, and so forth. Organizations need to truly ‘learn’ if they wish to survive.

Concluding perspectives

In an attempt to gain greater clarity on the nature and onset of nonlinear change we have freely borrowed and traded concepts from several scientific domains in a somewhat careless manner, but this practice may be justified on the grounds that it has proved useful in exploring nonlinear dynamics and more precisely nonlinear change in complex adaptive social systems. It once again underscored the appropriateness of a complexity perspective applied to organizations. It has raised awareness in particular to the incommensurate sensitivity with which organizations are viewed and managed while these institutions may be functioning in conditions of hypersensitive dependence on minor, virtually unnoticeable changes in context. This observation is consistent with Rosser’s (2002) conclusion that small incremental changes (in this instance the economic and institutional environment) may have enormous impact at certain points in a dynamically complex environment. This significantly raises the ante for ‘successful’ institutional management.

While the mystery of change in some areas will continue to defy comprehension, the notion of nonlinear change offers a useful, more detailed and an intuitively more logical account of dramatic, sudden and irreversible organizational change in particular. Indeed, this is one of the more pronounced contributions that a complexity perspective brings to the field of organizational change, namely its ability to further illuminate the relationship and transition dynamics between qualitatively different types of change occurring in organizations ‘on the edge’ (so to speak). In this sense it confirms, but more importantly further elaborates, the punctuated equilibrium view of organizational change (cf. Gersick, 1991) and more clearly explicates the organization’s transition from a gradual, incremental type of change to a sudden, rapid and dramatic form of change. It also provides a more plausible account of the precipitating conditions from which chaotic change emerges (cf. Marion, 1999). Many useful and potentially more productive research avenues for unravelling as yet unknown elements of change in complex social collectives are suggested by the phenomenon of nonlinear change.

The unsurprising observation that human emotion (and its inseparable relationship with idiosyncratic sensemaking), is central to the development of complex conditions and the onset of chaotic change in social systems (in the case organization for example), is an obvious, but under acknowledged and indeed underestimated, reality that demands greater institutional attention.

Nonlinear change consequently not only provides useful ‘evidence’ of system complexity with its implicit action agenda, but could serve as an early indicator of ‘more’ or ‘worse to come’. Early detection would enable some preparation in the form of capacity development and other forms of proactive strategizing. This in itself may not circumvent chaotic change (it may well also do this) but could minimize the potentially catastrophic impact of such change, i.e., influencing the change away from fatal towards nonfatal chaotic change.

References

Albrow, M. (1992). “Sine ira et studio: Or do organizations have feelings?” Organization Studies, 13(3): 313-329.

Anderson, P. (1999). “Complexity theory and organization science,” Organization Science, 10(3): 216-232.

Applebaum, S. H. and Wohl, L. (2000). “Transformation or change: Some prescriptions for health care organizations,” Managing Service Quality, 10(5): 279-298.

Ashmos, D. P., Duchon, D. and McDaniel, R. R. (2000). “Organizational responses to complexity: The effect on organizational performance,” Journal of Organizational Change Management, 13(6): 577-594.

Bamford, D. R. and Forrester, P. L. (2003). “Managing planned and emergent change within an operations management environment,” International Journal of Operations & Production Management, 23(5): 546-564.

Bartunek, J. M. (1993). “The multiple cognitions and conflicts associated with second order organizational change,” in J. K. Murnighan (ed.), Social psychology in organizations: Advances in theory and research, Englewood Cliffs, NJ: Prentice Hall.

Bartunek, J. M. and Moch, M. K. (1987). “First-order, second-order, and third-order change and organizational development interventions: A cognitive approach,” Journal of Applied Behavioral Science, 23(4): 483-500.

Beer, M. and Nohria, N. (2000). “Cracking the code of change,” Harvard Business Review, May-June: 133-141.

Beeson, I. and Davis, C. (2000). “Emergence and accomplishment in organizational change,” Journal of Organizational Change Management, 13(2): 178-189.

Bolton, M. and Heap, J. (2002). “The myth of continuous improvement,” Work Study, 51(6): 309-313.

Coleman, Jr., H. J. (1999). “What enables self-organizing behavior in businesses,” Emergence, 1(1): 33-48.

Collins, D. (1996). “New paradigms for change? Theories of organization and the organization of theories,” Journal of Organizational Change Management, 9(4): 9-23.

Collins, D. (1998). Organizational change: Sociological perspectives, London, UK: Routledge.

Czander, W. M. (1993). The psychodynamics of work and organizations: Theory and application, New York, NY: Guilford Press.

Dehler, G. E. and Welsh, M. A. (1994). “Spirituality and organizational transformation: Implications for the new management paradigm,” Journal of Managerial Psychology, 9(6): 17-26.

Demirguc-Kunt, A. and Detriagiache, E. (1998). “The determinants of banking crises in developing and developed countries,” IMF Staff Papers, 45: 81-109.

Dixon, N. M. (1999). The organizational learning cycle: How we can learn collectively, 2nd ed., Hampshire, UK: Gower.

Dooley, K. J. and Van de Ven, A. H. (1999). “Explaining complex organizational dynamics,” Organization Science, 10(3): 358-372.

Eisenbeis, R. A. (1997). “Bank deposits and credit as sources of systemic risk,” Economic Review, Federal Reserve Bank of Atlanta, Third Quarter: 4-19.

Elieli, R. B. L. (1994). “Psychoanalytic thinking and organizations,” Psychiatry: Interpersonal and Biological, 57(1): 78-91.

Epstein, S. (1994). “Integration of the cognitive and the psychodynamic unconscious,” American Psychologist, 49 (8): 709-724.

Epstein, S., Lipson, A., Holstein, C. and Huh, E. (1992). “Irrational reactions to negative outcomes: Evidence for two conceptual systems,” Journal of Personality and Social Psychology, 62(2): 328-339.

Fineman, S. (1993). “Organizations as emotional arenas,” in S. Fineman (ed.), Emotion in organizations, London, UK: Sage.

Flam, H. (1993). “Fear, loyalty and greedy organizations,” in S. Fineman (ed.), Emotion in organizations, London, UK: Sage.

Freedman, J. L. (1982). “Theories of contagion as they relate to mass psychogenic illness,” in M. J. Colligan, J. W. Pennebaker and L. R. Murphy (eds.), Mass psychogenic illness: A social psychological analysis, Hillsdale, NJ: Lawrence Erlbaum Associates.

Gersick, C. J. G. (1991). “Revolutionary change theories: A multilevel exploration of the punctuated equilibrium paradigm,” Academy of Management Review, 16(1): 10-36.

Goerner, S. J. (1995). “Chaos, evolution, and deep ecology,” in R. Robertson and S. Combs (eds.), Chaos theory in psychology and the life sciences, Mahwah: NJ: Lawrence Erlbaum Associates.

Goldstein, J. (1999). “Emergence as a construct: History and issues,” Emergence, 1(1): 49-72.

Golembiewski, R. T., Billingsley, K. and Yeager, S. (1976). “Measuring change and persistence in human affairs: Types of change generated by O. D. designs,” Journal of Applied Behavioral Science, 12: 133-154.

Greiner, L. E. (1972). “Evolution and revolution as organizations grow,” Harvard Business Review, 50(4): 37-46.

Grint, K. (1998). “Determining the indeterminacies of change leadership,” Management Decision, 36(8): 503-508.

Kindleberger, C. P. (1996). Manias, panics, and crashes: A history of financial crises, 3rd ed., New York, NY: John Wiley and Sons.

Levy, A. and Merry, U. (1986). Organizational transformation: Approaches, strategies, theories, New York, NY: Praeger.

Lewin, A. Y. (1999). “Application of complexity theory to organization science,” Organization Science, 10(3): 215.

Lewin, K. (1951). Field theory in social science, New York, NY: Harper & Row.

Lundberg, C. C. and Young, C. A. (2001). “A note on emotions and consultancy,” Journal of Organizational Change Management, 14(6): 530-538.

Maguire, S. and McKelvey, B. (1999). “Complexity and management: Moving from fad to firm foundations,” Emergence, 1(2): 19-61.

Marion, R. (1999). The edge of organization, Thousand Oaks, California: Sage Publications.

Mariotti, J. (1998). “10 steps to positive change,” Industry Week, 247(14): 82.

Maurer, R. (1997). “Transforming resistance,” HR Focus, 74 (10): 9-10.

McGill, M. E., Slocum, J. W. and Lei, D. (1992). “Management practices in learning organizations,” Organizational Dynamics, 21: 4-17.

McLarney, C. and Dastrala, R. (2001). “Socio-political structures as determinants of global success: The case of Enron Corporation,” International Journal of Social Economics, 28(4): 349-367.

Miller, V. (2003). “Bank runs and currency peg credibility,” Journal of International Money and Finance, 22: 385-392.

Mourier, P. and Smith, M. (2001). Conquering organizational change: How to succeed where most companies fail, Atlanta: CEP Press.

Nortier, F. (1995). “A new angle on coping with change: Managing transition!” Journal of Management Development, 14(4): 32-46.

Ortiz, G. (2002). “Recent emerging market crises: What have we learned?” The Per Jacobsson Lectures, Basil: The Per Jacobsson Foundation.

Pascale, R. T. (1999). “Surfing the edge of chaos,” Sloan Management Review, Spring 1999: 83-94.

Pettigrew, A. M. (1988). “Introduction: Researching strategic change,” in Pettigrew, A. M. (ed.), The Management of Strategic Change, Oxford, UK: Basil Blackwell.

Pettigrew, A. (1990). “Longitudinal research and change: Theory and practice,” Organization Science, 1: 267-292.

Prigogine, I. and Stengers, I. (1984). Order out of chaos: Man’s new dialogue with nature, Toronto: Bantam Books.

Reger, R. K., Mullane, J. V., Gustafson, L. T. and DeMarie, S. M. (1994). “Creating earthquakes to change organizational mindsets,” Academy of Management Executive, 8(4): 31-46.

Reynolds, R. and Ablett, A. (1998). “Transforming the rhetoric of organizational learning to the reality of the learning organization,” The Learning Organization, 5(1): 24-35.

Rosser, M. V. (2002). “Experiences of economic transition in complex contexts,” International Journal of Social Economics, 29(6): 436-352.

Sirois, F. (1982). “Perspectives on epidemic hysteria,” in M. J. Colligan, J. W. Pennebaker, and L. R. Murphy (eds.), Mass psychogenic illness: A social psychological analysis, Hillsdale, NJ: Lawrence Erlbaum Associates.

Smith, B. D. (2001). “Banks, short-term debt and financial crises: Theory, policy implications, and applications: A comment,” Carnegie-Rochester Conference Series on Public Policy, 54: 73-83.

Smith, P. A. C. and Saint-Onge, H. (1996). “The evolutionary organization: Avoiding a Titanic fate,” The Learning Organization, 3(4): 4-21.

Spiker, B. K. and Lesser, E. (1995). “We have met the enemy,” Journal of Business Strategy, 16(2): 17-21.

Staw, B. M. and Sutton, R. I. (1993). “Macro organizational psychology,” in J. K. Murnighan (ed.), Social psychology in organizations: Advances in theory and research, Englewood Cliffs, NJ: Prentice Hall.

Styhre, A. (2002). “Nonlinear change in organizations: Organization change management informed by complexity theory,” Leadership & Organization Development Journal, 23(6): 343-351.

Sullivan, T. J. (1999). “Leading people in a chaotic world,” Journal of Educational Administration, 37(5): 408-423.

Thiétart, R. A. and Forgues, B. (1995). “Chaos theory and organization,” Organization Science, 6(1): 19-31.

Tushman, M. and Romanelli, E. (1985). “Organizational evolution: A metamorphosis model of convergence and reorientation,” in L. L. Cummings and B. M. Staw, (eds.), Research in Organizational Behavior, Vol. 7, Greenwich, CT: JAI Press.

Van Tonder, C. L. (1999). Organization identity: An exploratory study, unpublished doctoral thesis, Johannesburg: RAU University.

Van Tonder, C. L. (2004a). “Organizational transformation: Wavering on the edge of ambiguity,” SA Journal of Industrial Psychology, 30(3): 53-64.

Van Tonder, C. L. (2004b). “The march of time and the ‘evolution’ of change,” SA Journal of Industrial Psychology, 30(3): 41-52.

Van Tonder, C. L. (2004c). Organizational change: Theory and practice, Pretoria: Van Schaik.

Waldersee, R. and Griffiths, A. (1997). “The changing face of organizational change,” CCC Paper No. 065, Centre for Corporate Change, Australian Graduate School of Management, The University of New South Wales, Sydney.

Watzlawick, P., Weakland, J. H. and Fisch, R. (1974). Change: principles of problem formation and problem resolution, New York, NY: Norton.

Weick, K. E. (1995). Sensemaking in organizations, Thousand Oaks, CA: Sage.

Zajonc, R. B. (1998). “Emotions,” in D. T. Gilbert, S. T. Fiske, and G. Lindzey (eds.), The handbook of social psychology, Vol 1, Boston, MA: McGraw-Hill.